Atlas America vs Safe Travels USA Comprehensive Insurance

Examine the similarities and differences between the advantages provided by Atlas America insurance and Safe Travels USA Comprehensive Insurance plans.

This article will help you understand Atlas America vs Safe Travels USA Comprehensive Plans and understand which plan better suits your travel insurance needs, for visiting the USA.

These visitor insurance plans are designed to provide medical coverage and trip insurance elements built in to provide you with comprehensive coverage.

Consider both the cost and the benefits of each travel medical insurance plan in order to choose the one that best suits your requirements.

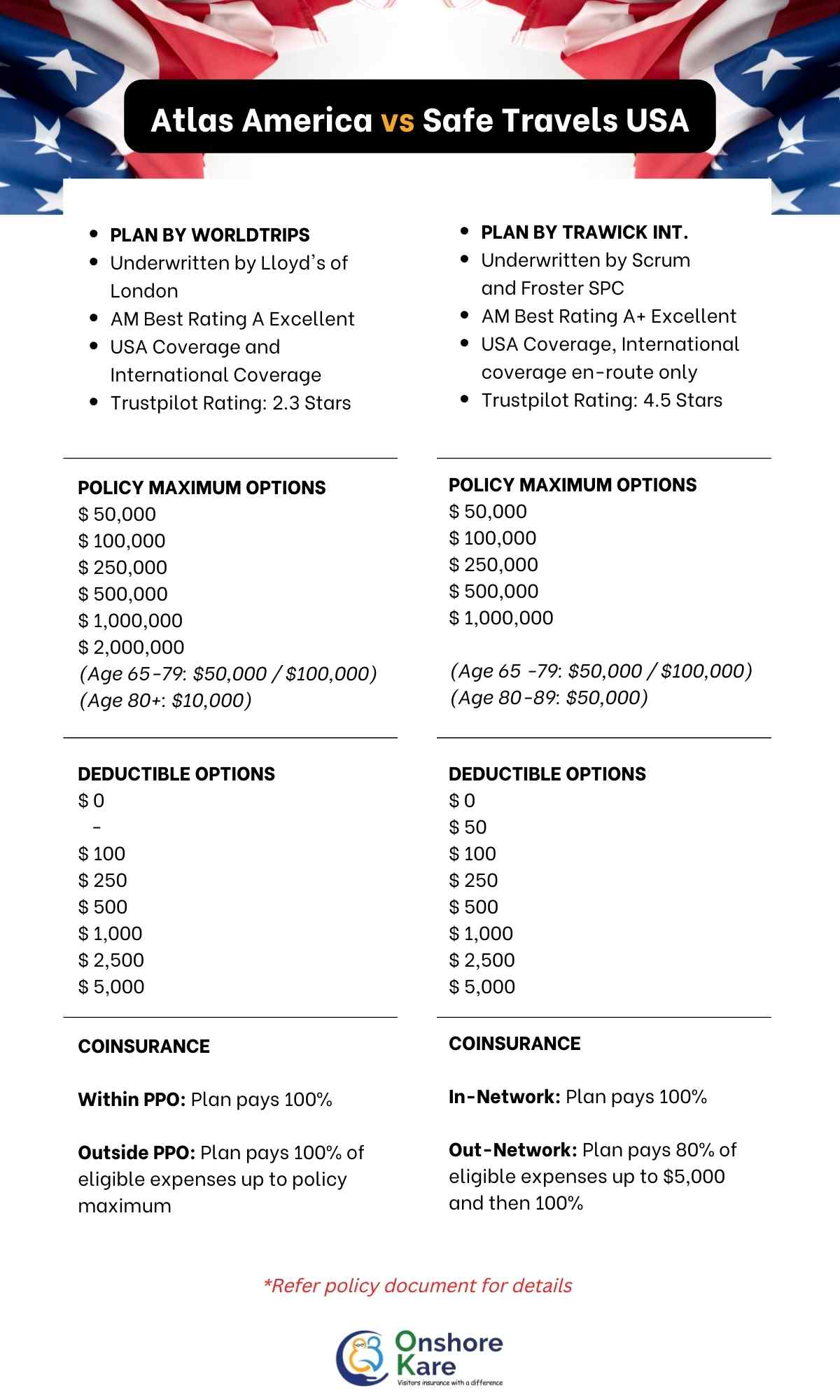

Key highlights: Atlas America VS Safe Travels USA Comprehensive Plans

About Atlas America Insurance

Atlas America Insurance meets the needs of non-U.S. citizens and residents who require coverage for temporary medical insurance needs while visiting the United States for business or pleasure.

Individuals, families, business travelers, and can access the Atlas America’s worldwide benefits seven days a week, 365 days a year.

Atlas America insurance is offered for a minimum of 5 days and a maximum of 364 days, with a wide range of plan maximum limits and deductible options. The plan is designed to cover your unforeseen medical expense when you are away from your home country.

In addition, Atlas Travel Insurance provides valuable travel and medical assistance services available 7 days a week, 365 days a year.

Atlas America Insurance is a highly popular visitors insurance for parents visiting USA. The plan extends coverage right from the time your parents leave the home country if the policy date is effective.

About Safe Travels USA Comprehensive Insurance

Safe Travels USA Comprehensive plan provides accident and illness medical coverage with Acute Onset of Medical Conditions to non-US residents who reside outside of the United States and are traveling outside their home country while visiting the United States or traveling to the United States and Worldwide. Covered en route to the U.S., while in the U.S., and in countries en route to the U.S. or on the return journey, in addition to countries on the itinerary.

Initial coverage can be obtained for a minimum of five (5) days and a maximum of 364 days. Coverage may be extended for up to 364 days at the prices in effect at the time of extension if a minimum of 5 days is purchased. This plan covers both insurance and other perks.

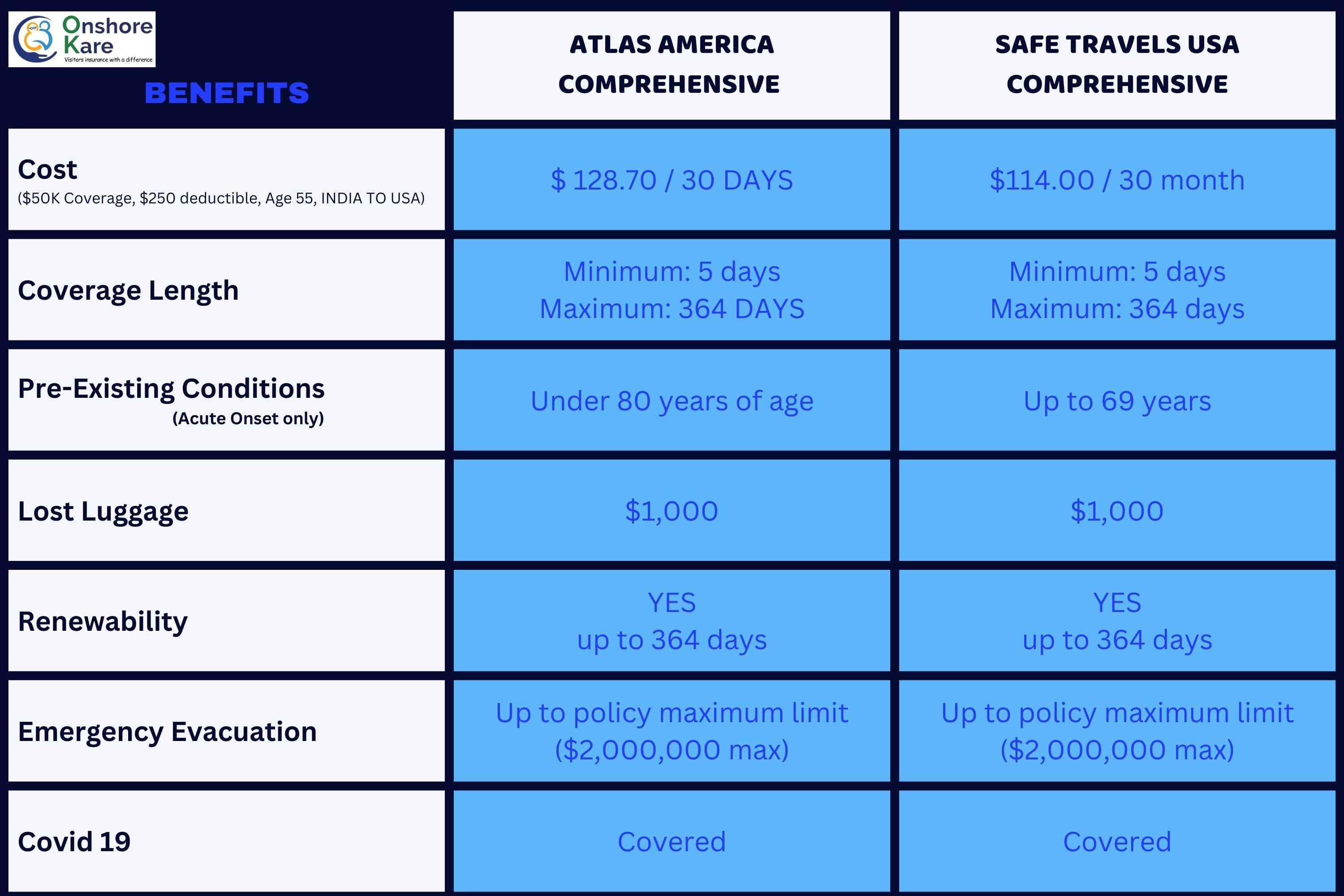

Covid 19 Coverage

Atlas America insurance offers Covid-19 coverage as any other illness or injury and meets the policy terms for an illness (illness occurred after the policy effective date). If covid-19 was acquired before the policy effective date then the plan will not provide covid coverage. Vaccination/boosters are not covered.

Safe Travels USA Comprehensive insurance offers coverage for Covid-19 expenses and treatment as any other illness/sickness.

So as far as Covid-19 is concerned the insured person is covered by both travel medical insurance plans during the policy period.

Atlas America Vs Safe Travels USA: What to Consider?

When comparing Atlas America Insurance with Safe Travels USA insurance, to purchase visitors’ insurance one should consider the following:

Policy Maximum:

Policy maximum coverage comparison of these plans:

- Atlas America Policy Maximum Limit: up to $ 2 million

- Safe Travels USA Policy Maximum Limit: up to $ 1 million

Atlas travel insurance offers 6 options on policy maximum:

- Option 1: $50,000

- Option 2: $100,000

- Option 3: $250,000

- Option 4: $500,000

- Option 5: $1,000,000

- Option 6: $2,000,000

The limit for Senior travelers with Atlas America insurance plan is much less.

-

- Age 65 to 79 $50,000, $100,000

- Age 80+ $10,000

Safe Travels USA comprehensive insurance plan offers 5 options on a policy maximum

- Option 1. $50,000

- Option 2: $100,000

- Option 3: $250,000

- Option 3: $500,000

- Option 4: $1,000,000

The limit for Senior travelers is much less.

-

- Age 80 to 89: $50,000

- Age 65 to 79: $50,000, $100,000

When you purchase travel insurance the cost of the premium increase if you select the higher Policy Maximum option. Higher Policy Maximum means more risk elements of the insurance policy for the insurer, they will have to pay out claims of higher amounts. International travelers visiting the USA need to keep in mind that medical expenses in the USA are very expensive and hence advisable to opt for a higher policy maximum even if it increases policy cost. Domestic health insurance from your home country will most likely not extend coverage while overseas.

Deductibles:

Atlas America insurance plan and Safe Travels USA visitor health insurance deductibles:

Before the insurer pays, the insured must pay the deductible amount. High-deductible plans cost less.

Atlas America and Safe Travels USA Comprehensive provide travelers’ deductible options.

- Atlas America has deductibles from $0 to $5000

- Safe Travels USA Comprehensive also has deductibles from $0 to $5,000

Network/PPO Network

Atlas America and Safe Travels USA travel medical insurance networks.

Insurance firms use PPO networks or healthcare networks to lower healthcare costs. If the insured is admitted to a provider network hospital or health care center, the insurance will cover higher qualified charges since the prices are lower at contracted rates. If an out-of-network medical facility is used then the insurance pays lower amounts.

- Atlas America PPO network is the United healthcare PPO network

- Safe Travels USA insurance PPO network is the First Health PPO Network

Coinsurance

Atlas America vs Safe Travels USA travel insurance coinsurance: Travelers pay this percentage of their bill.

Atlas America Insurance

After the deductible, the plan pays 100% of eligible medical expenses within the United Healthcare PPO network. Outside of the PPO network, the plan pays 100% of medical expenses up to the policy maximum.

Safe Travels USA Comprehensive

After the deductible, the plan pays 100% of eligible medical expenses within the First Health PPO network. Outside of the PPO network, the plan pays 80% of medical expenses up to $5,000, then 100% after that.

Plan Renewable?

Atlas America vs. Safe Travels USA travel health insurance renewability:

Travel plans sometimes change, requiring US visitors to stay longer.

Atlas America Insurance can be extended up to 364 days.

Safe Travels USA Comprehensive Insurance is also renewable up to a maximum of 364 days.

Travel Insurance Eligibility?

Both of these US visitor insurance policies cover short-term foreign visitors’ medical needs. These include medical expenses (eligible expenses), doctor’s visits, urgent care clinics,s, etc. The policy document defines the limits for medical treatments and other benefits.

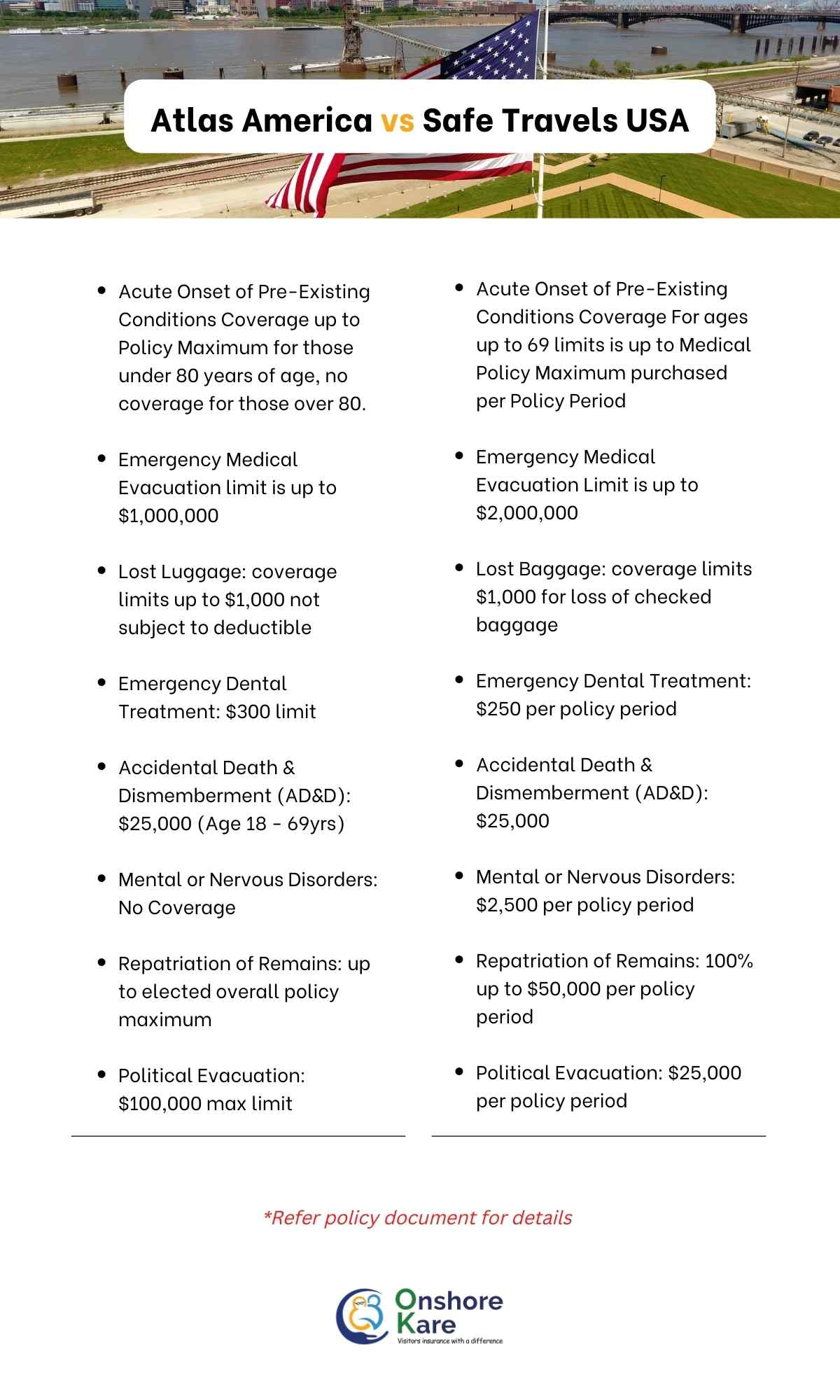

Pre-Existing Conditions

These plans extend acute onset of pre-existing condition coverage.

This is an important element to note if you have parents visiting the USA and you are looking for travel insurance with pre-existing condition coverage then these plans won’t meet your requirement. Most travel medical insurance plans are not designed to cover a pre-existing condition but only to cover emergency medical expenses when abroad.

Atlas America Insurance offers Acute Onset of Pre-Existing Conditions coverage under 80 years of age, up to the maximum limit. $25,000 maximum limit for medical evacuation in an emergency.

Safe Travels USA Comprehensive covers Acute a Pre-Existing Conditions, The maximum is up to the Medical Policy Maximum purchased per Period of Coverage for ages up to 69, except for heart disease or cardiac problems, which are limited to $25,000 for ages 69–70 and $15,000 for 70+. Acute Onset benefits will decrease to $35,000 at age 70, with a $25,000 lifetime limit for Emergency Medical Evacuation.

Read more on Pre-Existing Conditions covered in detail.

Emergency Medical Evacuation

Emergency Medical Evacuation can be critical when someone needs medical treatment not available anywhere nearby or needs to be transported to a special facial for treatment of an injury/sickness that is life-threatening.

Atlas America Insurance: Emergency Medical Evacuation must be approved in advance and coordinated by the company, the limit is up to $1,000,000

Safe Travels USA Comprehensive Insurance: 100% up to $2,000,000 per Policy Period

Please refer to the policy document of the respective policies for political evacuation, natural disaster evacuation, emergency reunion, and ‘repatriation of remains’ related limits.

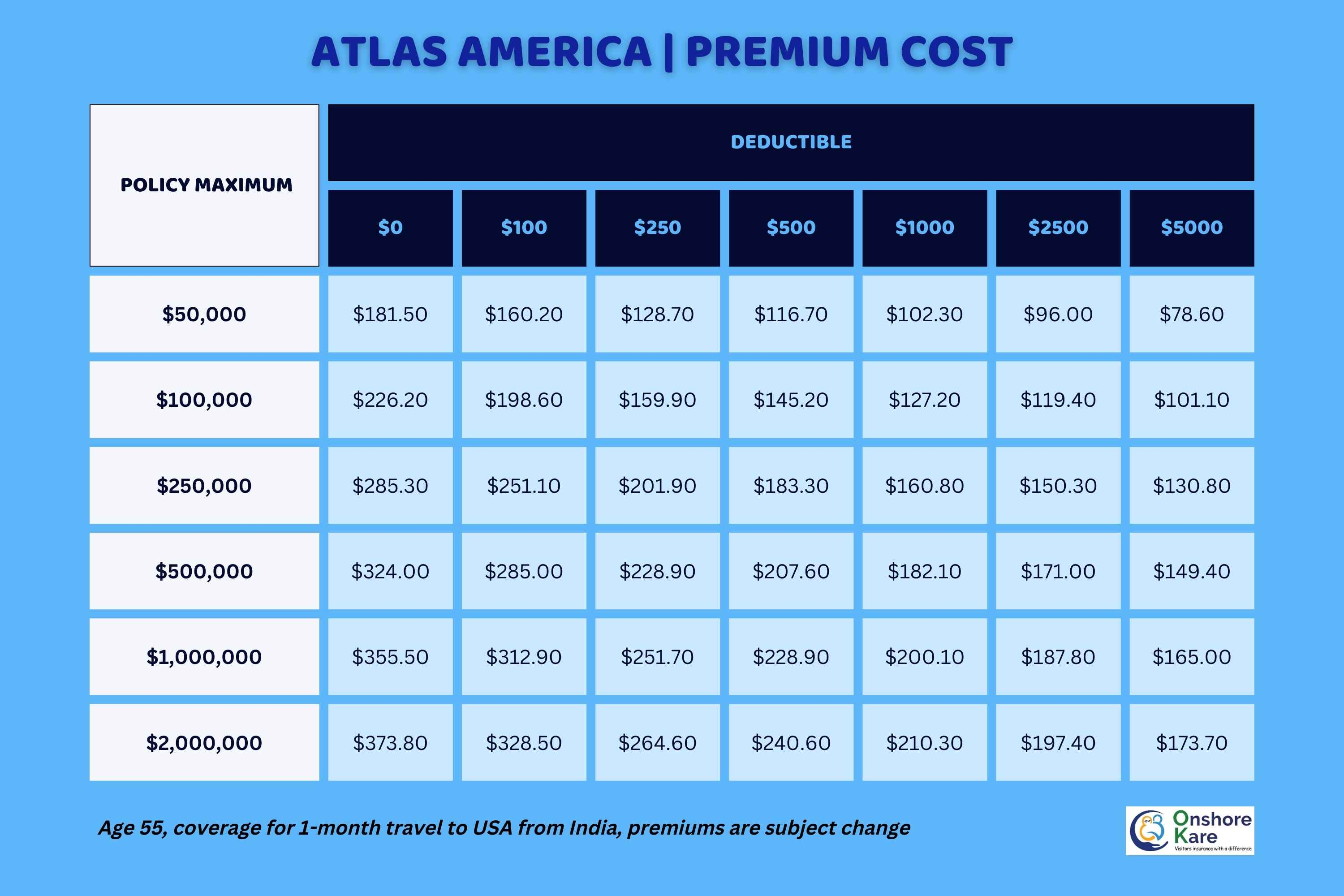

Travel Insurance Costs?

Both plans are very competitively priced.

Example of Atlas America Travel Insurance cost for a 55-year-old traveling to the USA from India for a month:

Example of Safe Travels USA Comprehensive Travel Insurance cost for a 55-year-old traveling to the USA from India for a month:

Frequently Asked Questions FAQs

Atlas America Insurance VS Safe Travels USA Comprehensive Insurance

Is WorldTrips a reputable travel insurance provider?

WorldTrips formerly Tokio Marine HCC-MIS specializes in International Travel Insurance plans and is reputed, read more about WorldTrips.

Is Atlas America a good travel insurance plan for my parents visiting USA?

Yes, this is a highly popular and one of the top-selling plans for parents visiting the USA. We have done a detailed review of the Atlas America Plan.

If your parents need emergency medical treatment in the USA it’s good to have medical expenses covered through travel insurance.

Are Pre-Existing Conditions covered by Atlas America Travel Insurance?

Yes, it provides acute onset of pre-existing condition coverage. This plan provides coverage for the acute onset of pre-existing conditions under the age of 80.

The limits are: Under 80 years of age, up to the policy maximum limit which is $50,000 or $100,000. The maximum limit for medical evacuation at $25,000

Is Trawick international a respectable insurance provider?

Trawick International was founded in 1998 and specialized in student insurance. Today Trawick International provides Travel Insurance to customers from around the world. their products include International Travel Insurance, Trip cancellation/interruption, and student insurance options. You can read our Review of Trawick International.

Is Safe Travels’ USA comprehensive a good option for visiting the USA?

Yes, Safe Travels USA Comprehensive insurance is a good option for non-US citizens or residents traveling outside their home country and visiting USA.

It is one of the highly popular visitor insurance options, we covered the plan in detail you can read our review of Safe Travels Insurance.

Can I purchase visitor insurance if my parents have already arrived in the USA?

Yes, you can purchase visitor insurance if your parents did not buy insurance from their home country and have already arrived in the USA.

Travel Insurance companies based in the USA will be able to provide you with many options for visitor insurance. You can also generate a no-obligation quote for your parents’ visitors’ insurance needs. You can also make an instant purchase online.

If I buy any of these 2 plans, will all the medical expenses be reimbursed?

Travel Insurance only covers medical expenses from the policy’s effective date. The policy document would be the best resource to see a detailed explanation of the condition that is covered and for how much.

It is always advisable when possible to contact the insurance company before undertaking expenses especially large medical expenses, this will help at the time of claims filing to be reimbursed without hassles.

What other option do I have in comprehensive coverage plans?

Read our detailed comparison of

- Atlas America VS Patriot America comprehensive coverage plans

- Patriot America Plus VS Safe Travels USA Comprehensive plans

Conclusion

We hope that this article helped with information on these Comprehensive plans, both plans are good and very popular for visitors’ insurance needs.

Evaluate your insurance needs and if you need help shortlisting a plan feel free to call OnshoreKare at +1 855 652 5565 or email info@onshorekare.com.

Travel Safe!