Atlas America vs Patriot America – which Travel Insurance Plan is better?

Atlas America and Patriot America are amongst the most popular travel insurance plans for visitors to the United States.

Many US Citizens/Residents who have their parents visiting USA, look for visitor health insurance travel to provide insurance coverage during their stay in the USA. Can one of these travel insurance plans meet your visitors’ insurance needs?

The United States healthcare system is widely regarded as among the best and most innovative in the world. however, it is also among the most expensive.

Without travel medical insurance, the costs associated with visits to a doctor or hospital can be exorbitant in the event of an unexpected illness, injury, or accident.

Whether or not you need visitor health insurance when you travel depends on your situation and the details of your trip. However, it is highly recommended that all travelers purchase some kind of travel insurance. Many policies cover trips lasting anywhere from 5 days to 365 days.

While a trip to the United States can be life-changing, it’s important to be prepared for the possibility of unexpected emergencies, such as illness or injury.

Without US visitor medical insurance, foreign nationals visiting the United States will face extremely high medical costs and a potentially traumatic experience if they become ill or injured while in the country.

Choosing the best travel medical insurance plan for the United States is complicated by the abundance of options available online.

Visitors to the United States should look around for travel insurance, paying special attention to US travel health plans such as Atlas America Insurance and Patriot America Plus Insurance, which provide excellent comprehensive coverage and medical benefits for both minor and major illnesses and injuries.

These visitor travel medical insurance plans are offered by specialist international travel insurance providers.

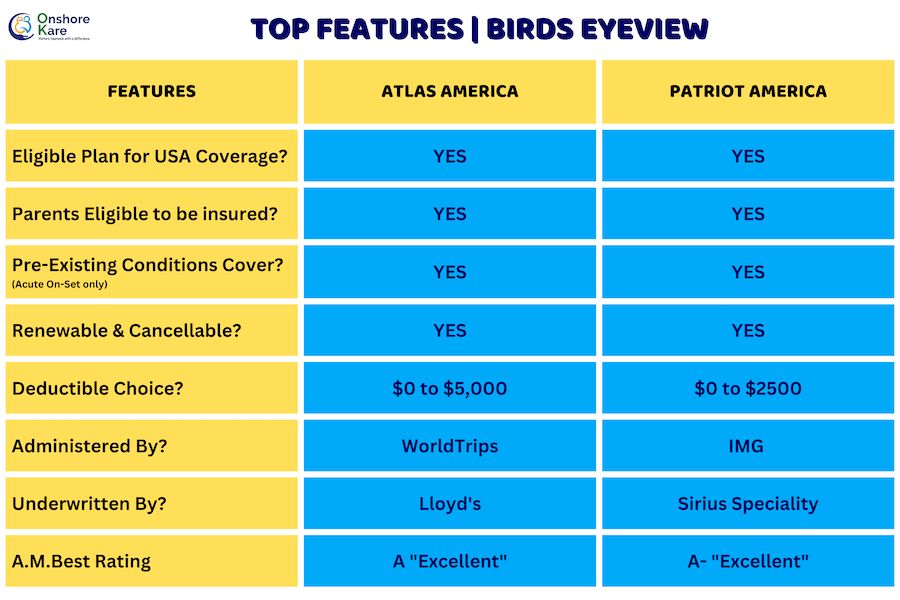

Atlas America is a product of WorldTrips, they provide travel health insurance services available to customers in more than 130 nations.

Patriot America is a product from International Medical Group (IMG), a provider of international health insurance for over 27 years

These travel insurance comprehensive plans for the United States are great for seniors and parents because they cover the sudden onset of pre-existing conditions.

This complete guide will help you learn all about the coverage and benefits of Atlas America and Patriot America Insurance plans. Here, you can evaluate the specific Visitors’ medical insurance benefits of the Atlas America insurance plan and the Patriot America Plus plan to see which one best suits your needs and budget.

Also, read Advantages of buying Travel Medical Insurance from the United States

Atlas America vs Patriot America: Which one is better?

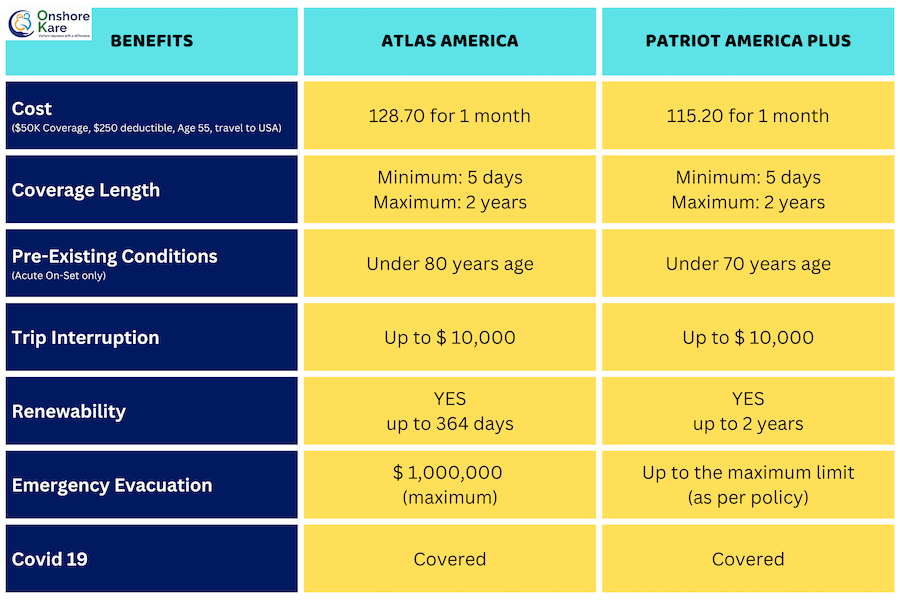

Atlas America differs significantly from Patriot America Plus in that it pays for the treatment of acute onset of pre-existing conditions up to the age of 80, whereas Patriot America provides coverage up to the age of 70.

Atlas America Travel Insurance

If you are planning to travel during the pandemic, this plan is your best choice. Atlas America travel insurance provides comprehensive coverage for a variety of medical costs including covid coverage.

The plan is available to both US citizens and non-citizens who are going outside of their home country. One must choose Atlas Travel if they are a US resident, while the other must select Atlas International if they are not.

Features:

- Protection for both outpatient and inpatient medical care in the event of illness or injury. And that includes situations requiring immediate medical attention such as emergency medical evacuation.

- Anyone under the age of 80 who has a pre-existing condition that suddenly worsens is covered.

- Any medical expenses incurred as a result of sports-related illness or injury are also covered by Atlas Travel.

- In addition, the first 26 weeks of pregnancy are covered for any complications that may arise.

- Maximum benefits under the plan start from $50,000 and can be as high as $2 million.

Patriot America Plus Insurance

The Patriot America Plan is designed for foreign nationals who must frequently visit the United States for business or academic purposes. Travel medical insurance that provides includes a comprehensive plan which includes coverage for covid-19 costs is essential because the United States is well-known for its high healthcare costs.

If you have parents, relatives, or friends coming to the United States on a short trip, this all-inclusive plan is the way to go. The insurance plan is ideal because it covers all of the costs associated with medical care, including hospitalization, medication, and emergency room visits.

Features

- The plan’s deductible can be set anywhere from $0 to $2500, and coverage can be purchased with a limit anywhere from $50,000 to $1,000,000.

- It protects those younger than 70 years old from the financial fallout of sudden onset, nonchronic, pre-existing conditions.

- United Healthcare PPO is where you can get recommendations for the best medical professionals, emergency rooms, and hospitals in your area.

- COVID-19 medical coverage is the same as all other types of medical coverage.

- There is a range of coverage options available, starting at 5 days and going up to 364 days, with an additional year of coverage available if needed.

Watch: Travel Insurance for Parents Visiting USA to understand why it is necessary to purchase travel medical insurance for your parents visiting USA

What should you look out for when deciding between WorldTrips and IMG visitor health insurance plans?

When deciding between Atlas America Insurance and Patriot America Plus Insurance, a foreign traveler should consider the following factors.

Maximum coverage between Atlas America insurance and Patriot America Plus insurance:

This is the maximum coverage the plan will pay toward the medical expenses:

- Atlas America Plan $2,000,000

- Patriot America Plus $1,000,000Protection levels for seniors may be lower than for younger tourists.

Deductible options between Atlas America insurance and Patriot America Plus insurance:

In both the Atlas America and Patriot America Plus plans, the deductible is the amount the traveler must pay before the insurance begins to pay for medical emergencies or other covered expenses. Both the Atlas America and Patriot America Plus insurance plans provide travelers with deductible choices. Deductibles for Atlas America insurance start at $0 and go as high as $5,000, while those for Patriot America Plus insurance go from $0 to $2,000.

Insurance provider network for Atlas America insurance and Patriot America Plus insurance:

Health care providers affiliated with Atlas America and Patriot America Plus insurance plans. These are created by insurance companies to manage healthcare costs. If the insured person is admitted to a hospital or other medical facility that is part of the insurance provider’s network, the insurance company will pay for all of the patient’s necessary medical care.

Coinsurance options for Atlas America insurance and Patriot America Plus insurance:

This represents a portion of the cost that the trip is responsible for. After the deductible, the Atlas America plan pays 100% of allowable costs up to the overall maximum. For coverage outside of the provider network, Patriot America Plus Insurance has some limitations. The plan pays 80% up to $5,000, and it pays 100% inside the provider network.

Options for renewing Atlas America and Patriot America Plus travel medical insurance policies:

If travelers’ plans change while in the United States, they may need to stay longer than originally anticipated. The Atlas America policy can be renewed for an additional 364 days, while the Patriot America Plus policy can be renewed for an additional 2 years.

Insurance plans for foreign visitors to the United States, including the popular Atlas America and Patriot America Plus plans:

Both of these visitor insurance policies for the United States provide extensive medical coverage for foreign nationals in the country for a temporary stay. H1b/H4 visa holders and students in opt status frequently purchase insurance from Atlas America because there are no restrictions on doing so after a certain amount of time has passed. Patriot America Plus must be purchased within 30 days of entering the United States due to a time limit.

Coverage for preexisting conditions under the Atlas America and Patriot America Plus policies:

In the event of an acute onset of a preexisting condition, Atlas America insurance will cover you until you turn 79 years old, while Patriot America Plus insurance will cover you until you turn 70 years old.

Frequently Asked Questions

Can long-term foreign visitors to the United States buy Atlas America insurance?

If you’ve been in the United States for a while but don’t have insurance yet, Atlas America is a good choice. OPT-eligible international students, those with an H1B visa, and H4-eligible spouses of H1B-eligible workers can all benefit greatly from this plan.

Why should I buy travel insurance from WorldTrips?

All of the destinations on your bucket list can be visited because of the comprehensive travel medical insurance and other trip protection services provided by world trips.

Since its acquisition by Tokio Marine in 2015, WorldTrips has served as an integral part of the organization. For international travelers, WorldTrips insurance provides some of the most comprehensive and innovative medical and trip protection plans available anywhere.

Does Atlas America provide maternity benefits?

Yes, during the first 26 weeks of pregnancy, Atlas America will cover any complications that may arise.

Do preexisting conditions get covered by Atlas America’s insurance?

If you already have health issues, you should look into Atlas America’s travel insurance. Preexisting condition insurance that covers the sudden onset of symptoms typically covers people up to age 80. Not even preexisting conditions or those that persist over time are covered by this. Coverage is provided up to the policy’s maximum age limit for tourists up to 70 years of age. Travelers between the ages of 70 and 79 are eligible for coverage up to the age group maximum or $100,000.

When I get to the United States, can I purchase Patriot America Plus insurance?

Patriot America Plus insurance policies can be purchased in the United States after entry. Passport holders over the age of 65 must purchase one within 30 days of departure. Those entering the United States who are younger than 65 years old have up to six months from the date of entry to purchase the Patriot America Plus.

Do pre-existing conditions get covered by Patriot America Plus Insurance?

There’s no doubt that, up until age 70, Patriot America Plus insurance provides the best protection against the sudden onset of preexisting conditions.

Insurance from Patriot America Plus: is it available to residents of the United States?

Americans living abroad who will soon be spending time in the United States can get Patriot America Plus Insurance. In order to qualify for Patriot America Plus insurance, U.S. citizens must have maintained a continuous overseas residence for the preceding six months and have an active health insurance policy.

Bottom Line

Expecting the unexpected is something that all experienced travelers know all too well. Travel medical insurance can help soften the blow if something unforeseen happens while in the United States.

It’s vital that you realize there is no perfect strategy that works for every single traveler. It is important for parents visiting the United States, business travelers, and vacationers to find a plan that meets their unique needs and provides the level of coverage they require while in the country. Some tourists may require comprehensive insurance, while others may be satisfied with just the minimum. Please read your policy details carefully and make note of what is and is not covered, regardless of the plan you select.