Travel Insurance for a Pre-Existing Condition – Visitors Protect

Travel insurance for a Pre-Existing Condition is a good option to have for an international travel because without medical insurance, international travel can be very risky. Most travelers assume their standard medical plan covers them, but it may not. If you have pre-existing medical conditions, it makes things even more complicated.

Most domestic health insurance plans don’t cover international travel. Avoid medical coverage uncertainty with a proper international travel insurance plan.

- Most travel insurance plans are designed to cover any new sickness or illness

- USA Visitors need Coverage for any medical treatment they may need in the country

- Parents visiting USA to meet their children may need coverage for pre-existing medical conditions.

- Healthcare in the USA is very expensive

Visitors Protect covers foreign visitors to the U.S., Canada, and Mexico. This temporary travel medical insurance covers pre-existing conditions, so you can relax and enjoy your international trip.

Visitors Protect is a plan from the International Medical Group (IMG), a well-known and reputed travel insurance provider.

Let us look at this travel insurance plan in detail and understand its advantages, scope, exclusions, and cost.

Watch a short video on Visitors Protect

About Visitors Protect Insurance

The Visitors Protect plan is designed exclusively for people making international trips to the United States, Canada, and Mexico.

If you have your parents or a family member coming to visit you in the USA you may want to buy travel insurance coverage for them and this plan should be considered. If your family member has pre-existing medical conditions the plan will cover them.

Since this plan covers Pre-existing conditions it will allow the visitor to focus more on enjoying their time abroad and less on worrying about their health care.

Visitors Protect Travel Insurance is a product from International Medical Group (IMG), one of the highly reputed insurance company and a specialist international travel insurance provider.

Visitors Protect Travel Insurance Plan – Key Highlights

There are very limited options in the marketplace for travel insurance plans that cover pre-existing medical conditions. Visitors Protect is an exceptional plan from this perspective, here are some key highlights of this travel insurance plan:

- Short-term travel medical insurance for USA, Canada, and Mexico

- Travel insurance coverage for pre-existing medical conditions

- Travel insurance coverage for individuals and their dependents

- Freedom to seek treatment with a hospital or a doctor of your choice

- Good travel insurance option for parents visiting the USA

- The age limit for medical coverage is from 14 days to 99 years

- Covers Covid-19 like any other covered medical condition

Pre-Existing Medical Condition, Alternative Travel Insurance provider

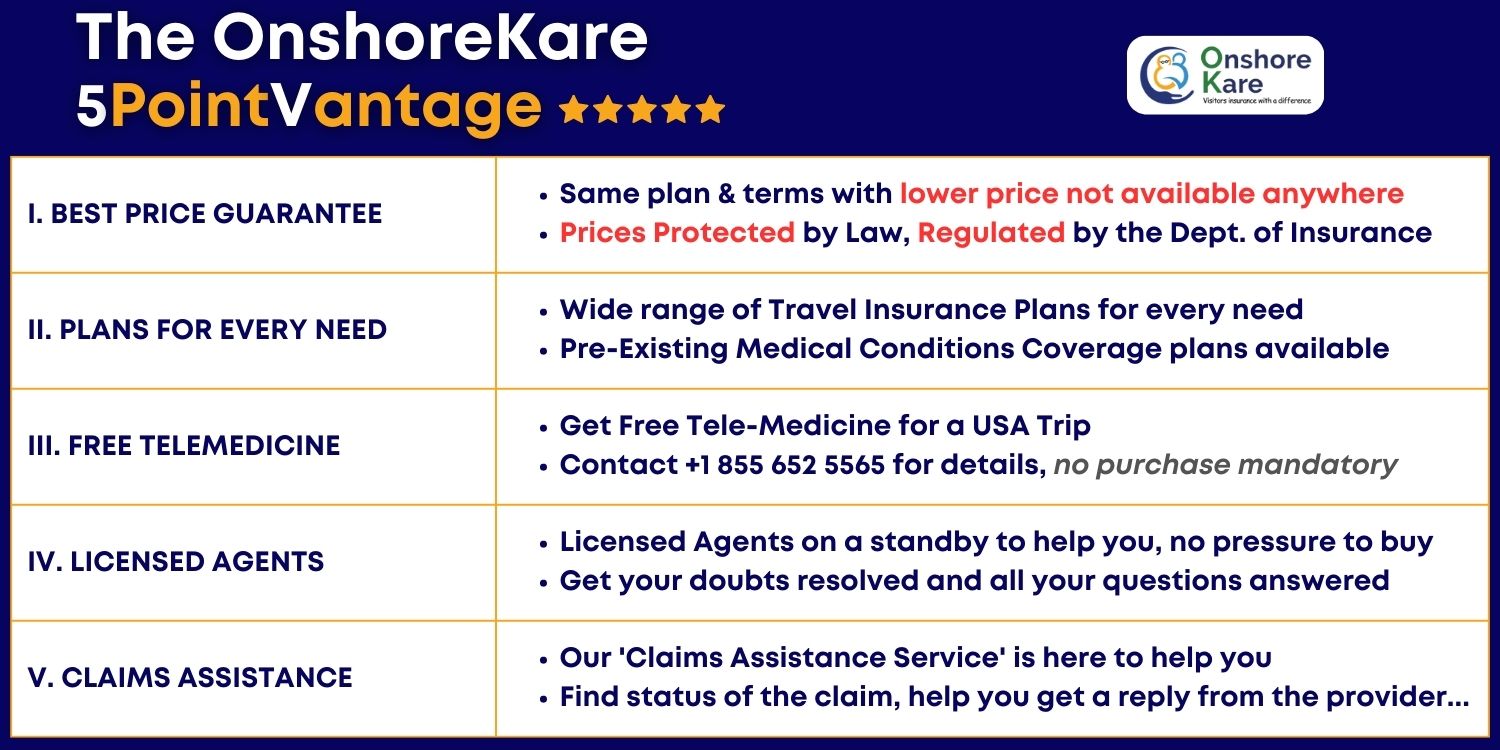

At OnshoreKare we provide a choice to international travelers for pre-existing medical condition coverage.

What are the eligibility criteria for Visitors Protect Insurance?

Visitors to the United States, Canada, and Mexico looking for travel insurance coverage can purchase Visitors Protect insurance.

You must enter your destination country lawfully on the effective date of coverage and pay the applicable premium on or before that date.

Visitors Protect Eligibility:

- Get visitors coverage for the USA, Canada, and Mexico

- Age Limit from 14 days to 99 years

- Travel Insurance Coverage for a minimum of 90 days to a maximum of 365 days

- This travel insurance plan is not extendable

- This travel insurance plan must be purchased before departing from your home country if you are traveling to the USA

Visitors Protect – Restriction to Buy Travel Insurance

Those with a primary residence or citizenship in the following countries will not be able to buy this travel insurance:

- Botswana (BWA), Canada (CAN), Cuba (CUB), Gambia (GMB), Ghana (GHA), Iran (IRN), Kosovo (XKX), Mexico (MEX), Niger (NER), Nigeria (NGA), North Korea (PRK), Pakistan (PAK), Puerto Rico (PRI), Sierra Leone (SLE), Syria (SYR), United States of America (USA).

Those with citizenship of the following countries wanting to buy health insurance for the USA cannot buy this travel insurance plan:

- Niger (NER), Nigeria (NGA), Puerto Rico (PRI), and Sierra Leone (SLE)

Purchasing travel insurance plan from the following U.S. states and territories are excluded for this product:

- Maryland (MD) and New York (NY)

Please Note: these are purchase restrictions only for these 2 US States. Coverage under this travel insurance policy continues even while tourists are visiting and staying in these states in USA.

Benefits of Visitors Protect Insurance

Visitors Protect is a Comprehensive Coverage Plan, some of the benefits of Visitors Protect Travel Insurance are:

- Pre-Existing medical conditions coverage

- Covid-19 Coverage

- Provides medical coverage during travel

- Emergency medical evacuation coverage

- Urgent care visits Covered

- Emergency room services

- Prescription medication covered

- United Healthcare PPO network

- Travel insurance plan pays for eligible medical treatment & expenses:

- After the Deductible, this travel insurance pays 75% within the PPO network

- After the Deductible, this travel insurance pays 60% of URC outside the PPO network

Read the travel insurance policy document carefully before you buy health insurance to know all the details, inclusions and exclusions. Limits apply for pre existing medical conditions coverage.

Coverage Offered by Visitors Protect Insurance

Medical Coverage:

Policy Maximum Options Per Injury or Illness are:

Through Age 69:

- $50,000 | $100,00 | $250,000

Age 70 and older:

- $50,000

The policy maximum limits may vary by the age of the traveler and/or destination.

Deductible Options available are:

- $250 | $500 | $1,000 | $2,500 | $5,000

The deductible limits may vary by the age of the traveler and/or destination.

Eligible Medical Expenses: In-Network 75% of policy maximum and Out-Network 60% of policy maximum

Emergency Coverage:

- Emergency Evacuation: Emergency medical evacuation coverage up to $25,000

- Return of Mortal Remains: Up to $25,000

- AD&D (Accidental Death & Dismemberment): Up to $25,000

What are Pre Existing Conditions? Is Pre-Existing Condition coverage provided by Visitors Protect Insurance?

What are considered pre existing medical conditions?

A pre-existing condition is a medical condition or health problem that an insured person has had before the policy’s effective date and for which they have received treatment or are currently taking medication.

Each Insurance company has its own definition and look back period when it comes to pre existing medical conditions, its good to refer to the explanation in the policy document before you buy a travel insurance plan.

Does Visitors Protect Travel insurance provide coverage for Pre existing medical conditions?

Yes, Visitors Protect Travel insurance provides coverage for a pre existing medical condition as defined in the policy terms and conditions:

- Up to age 69 the coverage is up to $25,000 for pre existing medical conditions

- For age 70 and above the coverage is up to $20,000 for pre existing medical conditions

Please note that there is no coverage provided for the acute onset of a pre existing medical condition.

When choosing travel medical Insurance for parents with pre existing medical conditions, it is important to consider their insurance needs and any pre-existing condition they may have.

Other Travel Insurance Plans for Pre-Existing Conditions

If you searching for travel insurance for coverage of a pre-existing condition you can also review the following plans:

Please note that Hop! TripAssist Plus and Hop! Mindoro are Travel Assistance Plans and not Travel Insurance plans.

About the Insurance company of Visitors Protect Insurance – IMG

International Medical Group (IMG) is amongst the reputed travel insurance companies specializing in providing international travel insurance.

Their travel insurance plans like Patriot America Plus, Patriot Platinum plans are highly popular.

IMG travel insurance company is owned by SiriusPoint, a multi-billion dollar company with A.M. Best Rating of “A” delivers top quality travel insurance product offerings.

With a Trustpilot rating of 4.6 with over 7,000 reviews

IMG is a prominent travel insurance company

Nn most rankings of travel insurance providers, IMG gets ranked as one of the top travel insurance companies

IMG as a Travel Insurance Company has provided global benefits and assistance services to millions of customers in nearly every country around the world

IMG the travel insurance company through its partnerships with other service providers extends several benefits its customers like:

- Self Service Member Portal

- Pharmacy Discount Savings

- U.S. Network Access

- International Provider Access

Key Takeaways

- Visitors Protect Travel Insurance is an excellent insurance policy for you and your traveling companion visiting USA including Canada and Mexico

- This is a good option for those looking to buy travel insurance with pre-existing medical condition Coverage for their parents visiting USA

- This plan offers United Healthcare PPO access in the USA

- Need to buy for a minimum of 90 days to a maximum of 364 days

- Comes with excellent service promise from IMG Travel Insurance Company

- IMG is rated among the best travel insurance companies

- The plan offers a choice to avail treatment from a hospital or a doctor of your choice

FAQ Section

Is high blood pressure a pre existing medical condition for travel insurance?

Yes, high blood pressure is considered a pre existing medical condition for travel insurance

Can I get travel insurance if I have a pre-existing condition?

Yes, it is possible to get travel insurance with pre existing medical condition.

Does international health insurance cover pre-existing conditions?

Pre-existing conditions are typically excluded from coverage in international health insurance plans, But some plans may provide benefits for Acute onset of pre existing conditions

What is the waiting period for pre-existing conditions?

The waiting period for pre existing condition can vary depending on the travel insurance plan. Some plans provide coverage only if the acute onset occurs after a specified waiting period, which varies from 72 hours to seven days

What is the acute onset of a pre-existing condition?

The acute onset of a pre existing condition refers to a sudden and unexpected recurrence of a pre existing medical condition that requires immediate medical attention

What qualifies as a pre-existing condition?

A pre existing condition is a health problem or medical condition that existed before the start date of a new health coverage or insurance policy

What is the waiver of pre-existing medical condition exclusion?

The waiver of pre existing medical condition exclusion, is a plan provision that waives the exclusion for pre existing medical conditions in a travel insurance plan. This means you may still be eligible for coverage, for medical issues, related to that coverage, despite the exclusion

Can you buy just medical travel insurance?

Yes, you can buy just medical travel insurance for medical emergencies and unexpected medical costs while traveling abroad

What is an unexpected recurrence of a pre-existing condition?

An unexpected recurrence of a pre existing condition refers to a sudden and unforeseen flare-up or worsening of a pre existing medical condition that requires immediate medical attention while traveling

Conclusion

If you have a pre-existing medical condition and are planning to travel, it’s essential to consider purchasing travel insurance that covers your condition. Visitors Protect from IMG is one such travel insurance policy that offers coverage for pre-existing conditions.

Consider purchasing Visitors Protect from IMG or a similar travel insurance policy to protect yourself from unexpected medical expenses and ensure a stress-free trip.