Visitors Insurance Comparison: Atlas America vs Patriot America vs Safe Travels USA Insurance

Every experienced traveler is aware of the need of being prepared for the unexpected while traveling. Travel medical insurance might soften the damage if the unexpected happens while in the US.

Although healthcare and medical technology in the US are among the greatest and most sophisticated in the world, they are also typically far more expensive than in other countries.

If you are planning to purchase visitors insurance, always compare the plans because this will help you find the best visitor insurance plans for your parents visiting USA.

This article will compare the benefits and comprehensive coverage provided by the three plans to help you decide which one meets your travel insurance needs for visiting the USA.

Let’s understand the similarities and differences between each travel medical insurance plan.

Key Highlights: Atlas America vs Patriot America vs Safe Travels USA Travel Medical Insurance Plans

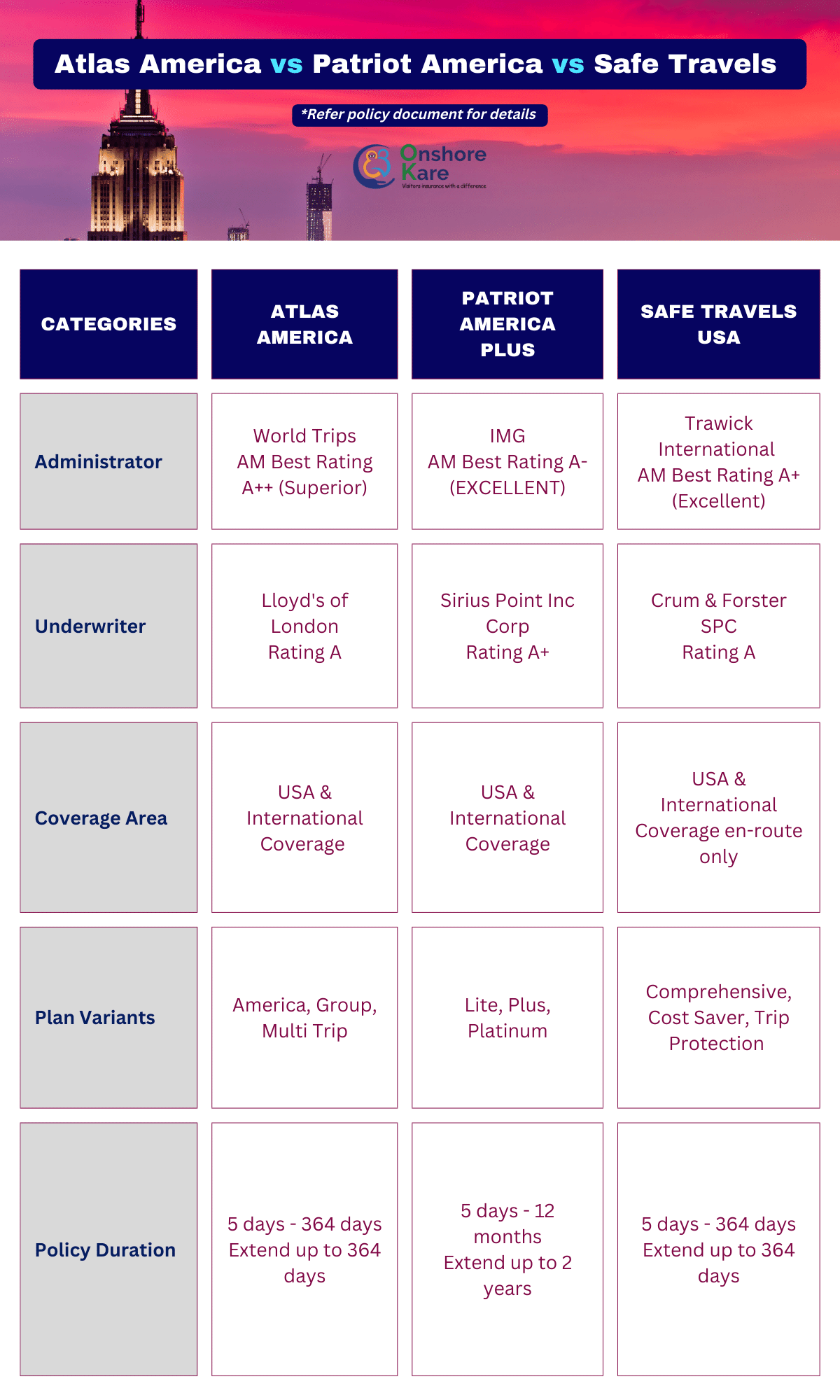

Although there are several visitor insurance plans available, Atlas America, Patriot America Plus, and Safe Travels USA are some of the best-selling travel medical insurance plans which provide comprehensive coverage policies for Indian visitors traveling to the USA.

Every one of the plans, which is provided by several policy underwriters and plan administrators who are all respected companies, offers excellent coverage for travelers to the USA and is relatively similar to each one of them. The key distinction between the three policies is that Patriot America and Safe Travels covers the acute onset of pre-existing condition up tp the age of 70 and 69, respectively while Atlas America provides this benefit up to age 80.

Despite their resemblances, these three plans differ significantly. With the aid of the comparison table below, you can select the strategy that best suits your requirements.

About Atlas America Travel Insurance

When non-US citizens travel to the USA for either business or pleasure, Atlas America Insurance fills their temporary medical insurance needs.

Anyone can use the international benefits of Atlas America, including individuals, families, and business travelers.

With a wide selection of plan maximum limits and deductible options, Atlas America travel insurance is available for a minimum of 5 days and a maximum of 364 days. When you are traveling outside of your native country, the plan is intended to cover any unexpected medical costs.

Atlas America Travel Insurance also offers helpful travel and healthcare services that are accessible 7 days a week, 365 days a year.

For parents traveling to the USA, Atlas America Insurance is a very well-liked visitors insurance. If the policy date is effective, the plan begins to provide coverage as soon as your parents depart their home country.

About Patriot America Plus Comprehensive Travel Insurance

When visiting the US for business or pleasure, non-US citizens who need complete coverage for temporary medical insurance needs can get it with Patriot America Plus.

The plan’s extensive worldwide benefits are accessible to individuals, families, business travelers, and parties of five or more passengers throughout the clock, seven days a week.

With a variety of plan maximum limits and deductible options, the Patriot America Plus plan is available for a minimum of five days and a maximum of two years.

Your unexpected medical expense will be covered by the Patriot America Plus plan.

The Patriot America plan also offers great benefits and services to meet your needs for foreign travel.

You will have access to multilingual customer service centers that operate internationally, claims administrators who can handle claims in almost any language and currency and highly trained coordinators of emergency medical services and international treatment who are available 24/7. Regardless of where you buy the plan, you can use this service.

For parents traveling to the USA, this visitor insurance is very popular. If the policy date is effective, the plan begins to provide coverage as soon as your parents depart their home country.

See our video on the top 10 reasons to buy Patriot America plus travel medical insurance plans.

About Safe travels USA comprehensive insurance

The Safe Travels USA Plan is a short-term primary accident and sickness medical insurance package made available to international travelers heading to the USA and other destinations on the itinerary.

It is one of the few complete insurance policies that offer an 80-year-old and older population a $50,000 policy maximum.

Being a member of the First Health PPO Network gives you access to a network of doctors, hospitals, urgent care centers, labs, and other healthcare providers. There is no network for pharmacies, dentists, or ambulances.

This plan offers comprehensive medical coverage to non-citizens of the United States who live outside the country and are traveling abroad to visit either just the United States or both the United States and other countries. It is not accessible to US citizens with green cards or those who are 90 years old or older.

A minimum of five (5) days and a maximum of 364 days are available for initial coverage. If a minimum of 5 days is purchased, coverage may be extended for a maximum of 364 days at the costs in effect at the time of an extension.

Read our travel insurance reviews on each of these plans:

- Atlas America Review

- Patriot America Plus Review

- Safe Travels USA Review

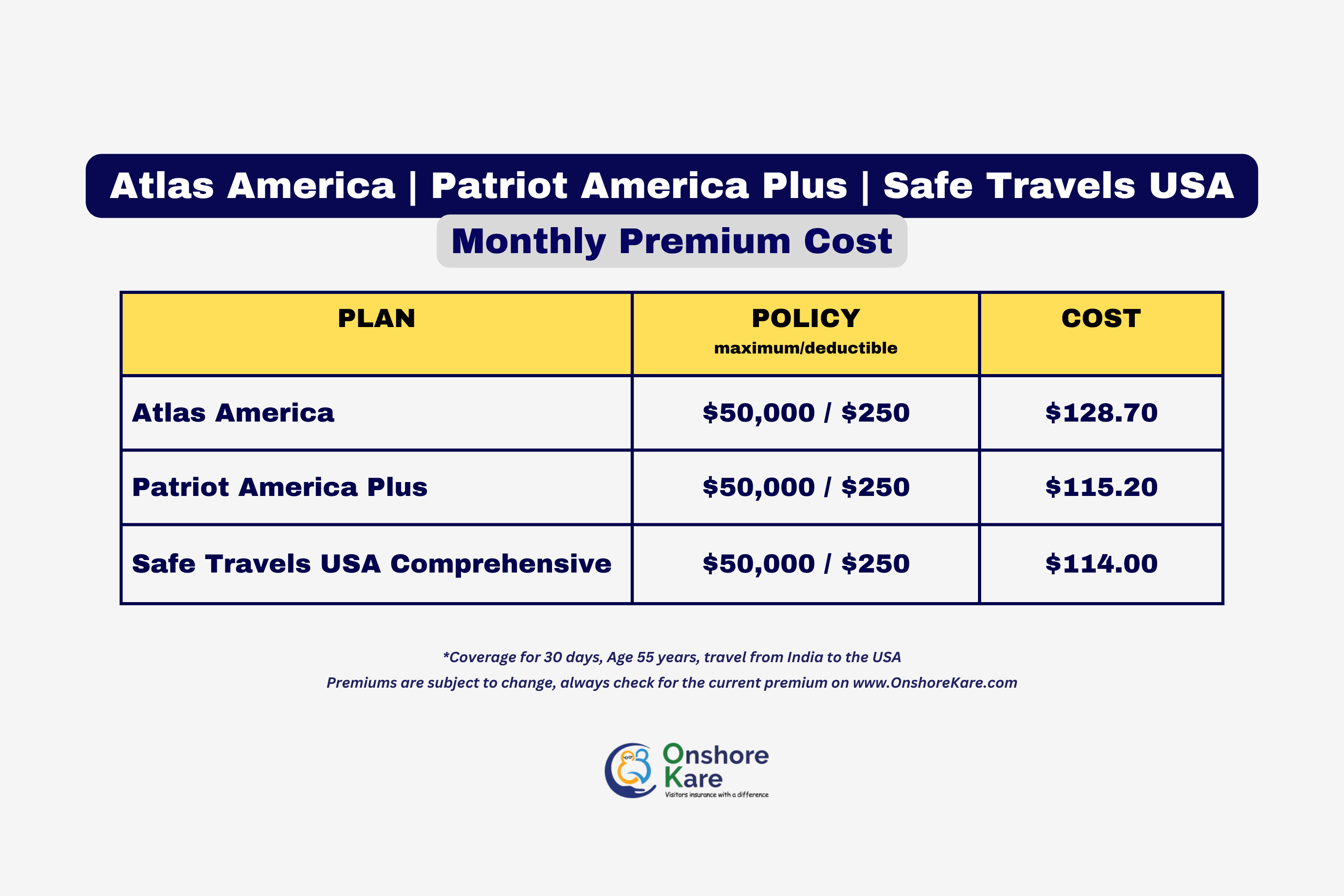

How much do the plans cost?

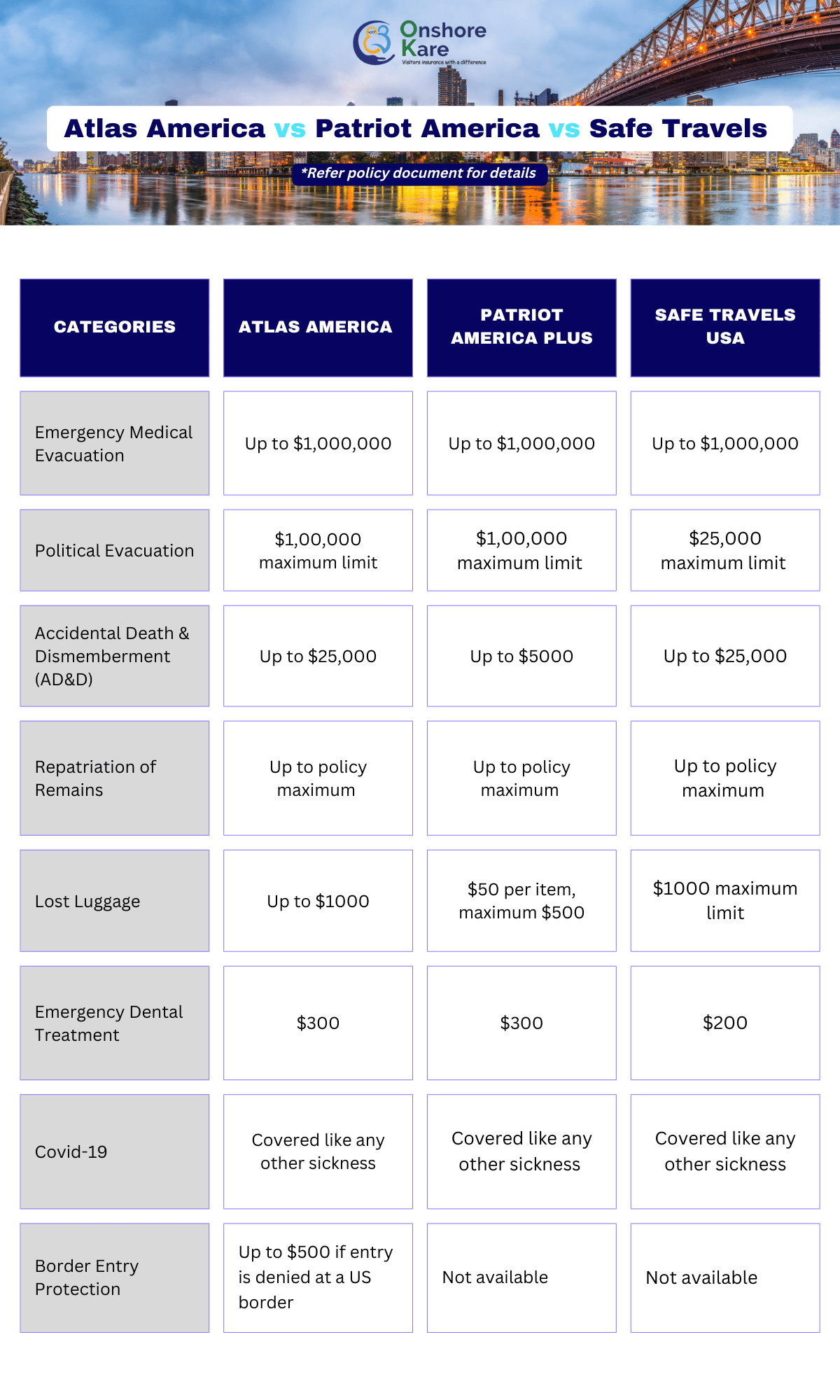

Covid 19 Coverage

Atlas America travel insurance offers coverage for Covid-19 expenses and treatment as any other illness/sickness as per policy terms.

Patriot America travel insurance also provides Covid-19 coverage as any other illness or injury and meets the policy terms for an illness (illness occurred after the policy effective date).

In accordance with the rules of the policy, Safe Travels USA Comprehensive travel insurance provides coverage for Covid-19-related costs and other medical benefits.

If covid-19 was acquired before the policy effective date then the plans will not provide covid – 19 coverage.

So as far as Covid-19 is concerned the insured person is covered by all the travel medical insurance plans during the policy period.

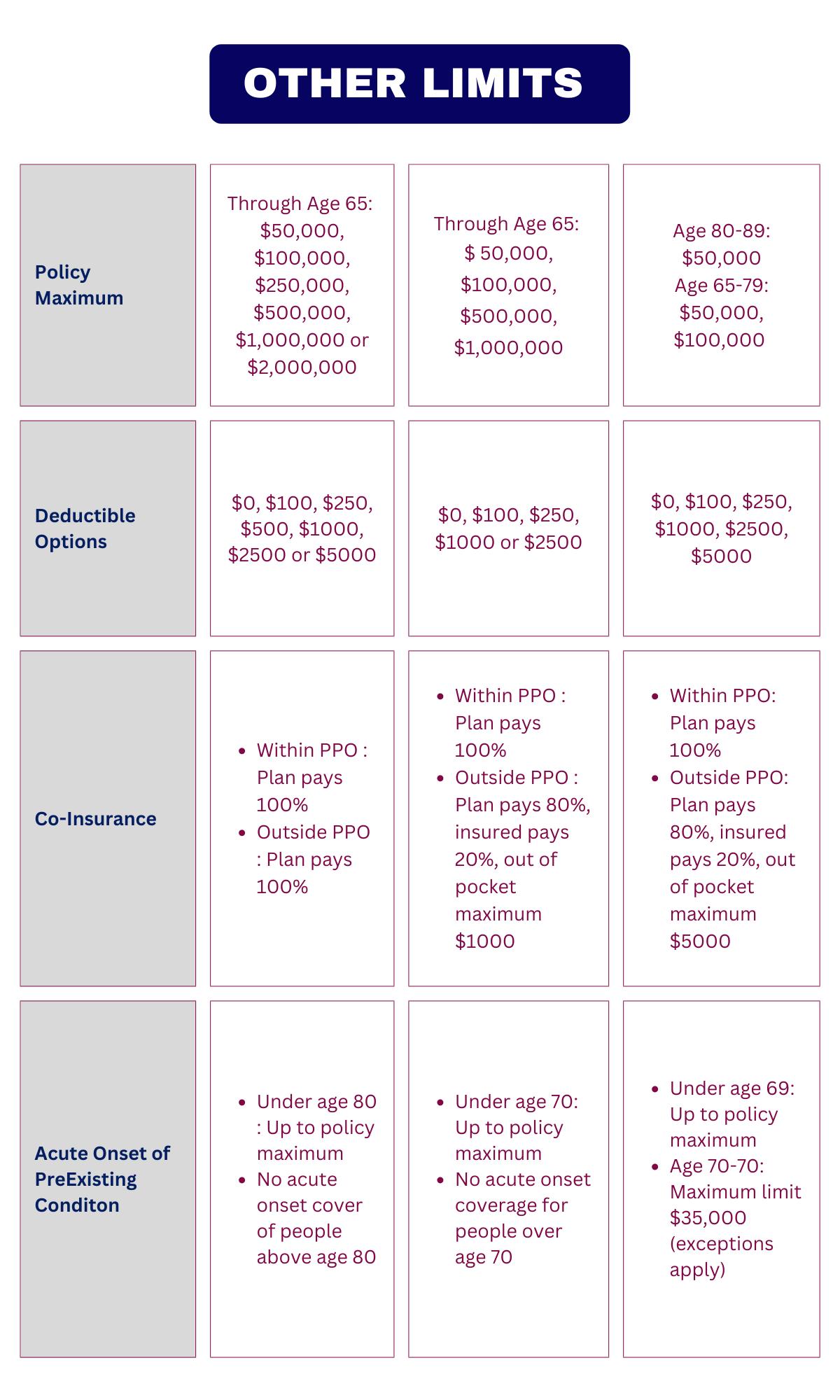

Pre-Existing Condition Coverage

The acute onset of pre-existing conditions is covered by these travel medical insurance policies.

Under 80 years of age, Atlas America Insurance provides Acute Onset of Pre-Existing Conditions coverage up to the maximum amount. The maximum amount for medical evacuation in an emergency is $25,000.

Acute and Pre-Existing Conditions are covered by Safe Travels USA Comprehensive. Safe Travels USA Comprehensive covers Acute and Pre-Existing Conditions. The maximum is up to the Medical Policy Maximum purchased per Period of Coverage for ages up to 69, with the exception of heart disease or cardiac problems, which are limited to $25,000 for ages 69-70 and $15,000 for ages 70 and up. Acute Onset benefits will be reduced to $35,000 at the age of 70, with a lifetime limit of $25,000 for Emergency Medical Evacuation.

Up to the maximum amount, Patriot America Plus travel medical insurance covers the acute onset of pre-existing conditions in people under the age of 70. The maximum amount for medical evacuation is $25,000

Policy Maximum:

Policy maximum coverage comparison of these comprehensive coverage plans:

- Atlas America Policy Maximum Limit: $ 2,000,000

- Patriot America Plus Policy Maximum Limit: $ 1,000,000

- Safe Travels USA Comprehensive Policy maximum limit: $ 1,000,000

Patriot America Plus provides a 2 times higher option as a max coverage option under its travel medical insurance policy.

Atlas travel insurance offers 6 options on policy maximum:

- Option 1: $50,000

- Option 2: $100,000

- Option 3: $250,000

- Option 4: $500,000

- Option 5: $1,000,000

- Option 6: $2,000,000

The limit for Senior travelers with Atlas America insurance plan is much less.

-

- Age 65 to 79: $50,000, $100,000

- Age 80+ : $10,000

Patriot America Plus offers 4 options on policy maximum:

- Option 1. Policy Maximum of $50,000

- Option 2: Policy Maximum of $100,000

- Option 3: Policy Maximum of $500,000

- Option 4: Policy Maximum of $1,000,000

The policy maximum for Senior travelers is much less.

- Insurance policy maximum:

- Age 65 to 69: $50,000 or $100,000

- Age 70 to 79: $50,000

- Age 80 and older: $10,000

Safe Travels USA comprehensive insurance plan offers 5 options on a policy maximum

- Option 1. $50,000

- Option 2: $100,000

- Option 3: $250,000

- Option 3: $500,000

- Option 4: $1,000,000

The limit for Senior travelers is much less.

-

- Age 80 to 89: $50,000

- Age 65 to 79: $50,000, $100,000

Atlas America provides more coverage options and higher policy maximum limits. How does this help the insured person? Higher policy maximum limit coverage means the plan pays for treatment up to that amount or limits as defined in the policy terms. International visitors to the USA should be aware that medical costs in the US are very high; it is therefore advised to purchase travel insurance with a higher policy maximum, even if doing so raises the cost of the policy. Most likely, the domestic health insurance from your native nation will not provide coverage when traveling.

Insurance companies of the plans and their benefits

Atlas America – WorldTrips

In order to meet the insurance needs of travelers all over the world, WorldTrips offers a wide range of travel medical insurance and trip protection insurance products.

WorldTrips was founded in 1998 and was acquired by Tokio Marine Holdings Inc. in 2015 to increase its global reach.

Numerous people, families, businesses, and service groups all over the world use WorldTrips travel medical and trip protection insurance.

We have covered WorldTrips in detail, you can read it here.

Patriot America plus – IMG

IMG Travel Insurance company is one of the reputed and leading visitor insurance providers based out of Indianapolis.

International Medical Group (IMG) is a provider of global health and visitors insurance. The company offers a range of insurance products and services for individuals, families, and businesses, including travel medical insurance, international health insurance, and emergency assistance services.

IMG provides coverage for individuals traveling abroad, as well as expatriates living and working in other countries. The company has a network of providers and medical facilities around the world and offers 24/7 access to assistance services.

Some of the benefits of plans offered by International medical group are:

- Comprehensive plans offer coverage and access to a wide PPO Network

- They offer customer assistance and service so you can always have access when you need

- IMG offers a wide variety of travel health insurance plans for every need

Check out our complete coverage of IMG Travel Insurance

Safe Travels USA – Trawick International

Trawick International, a company that was established in 1998, provides travelers from all over the world with a wide range of insurance solutions. They keep looking into innovative ideas to meet the demands of visitors everywhere.

International travel medical insurance and international student health insurance are two of Trawick International’s specialties.

The following are some advantages of the plans provided by Trawick International:

- For anyone going outside of their home country, they offer medical expenses coverage, emergency medical evacuation, emergency medical treatment, repatriation, emergency reunion, security/political evacuation, and much more.

- Trawick International provides access to a vast global network of top-notch medical facilities, hospitals, and pharmacies, both domestically and abroad.

We have also covered Trawick International in detail, you can read it here.

Other Coverages

Any illness or injury that is covered by travel health insurance is paid for as eligible medical expenses. Any incident that the insurance document defines as covered will also be paid for or repaid to you in accordance with the conditions and restrictions in the policy document.

Let’s have a look at the other benefits provided by Atlas America vs Patriot America vs Safe Travels USA in the table below

Safe Travels USA cost saver plan insurance

Visitors to the USA are covered by the Safe Travels USA Cost Saver Insurance, a complete insurance program, up to the age of 90.

It is a supplemental health insurance that offers all of the options offered by Safe Travels Medical Insurance and coordinates and pays for medical expenses that the primary health plan does not, such as medical evacuation, co-insurance, and deductibles.

Safe Travels USA Cost Saver Insurance is incredibly well-liked in the 80+ age group since they offer a policy maximum of $50,000 for this age group.

Frequently Asked Questions

IS IMG A REPUTABLE TRAVEL INSURANCE PROVIDER?

International Medical Group (IMG) specializes in International Travel Insurance plans and is highly reputed, read more about is IMG Travel Insurance worth it.

Since 1990, the International Medical Group (IMG) has offered travel insurance packages. IMG is headquartered in Indianapolis in the state of Indiana in the USA and employs more than 300 employees. They cater to the travel insurance needs of individuals, groups, and business travelers.

IS PATRIOT AMERICA PLUS A GOOD TRAVEL INSURANCE FOR MY PARENTS VISITING USA?

Yes, this is a highly popular and one of the top-selling plans for parents visiting the USA. We have done a detailed review of the Patriot America Plan.

If your parents need emergency medical treatment in the USA it’s good to have medical expenses covered through visitors insurance.

Is coronavirus covered by Safe Travels USA Comprehensive?

As long as the virus is contracted after the policy’s effective date and you have left your home country, COVID-19 is a covered condition under Safe Travels USA Comprehensive and will be handled in the same way as any other qualifying medical condition.

Atlas America or patriot America plus or safe travels USA: WHICH IS BETTER?

Your need for travel insurance will determine the best type of insurance. Visitors to the United States are provided with medical insurance coverage. All three insurance provides comprehensive coverage including emergency medical evacuation and other medical benefits

If your parents are elderly travelers visiting us in the USA, we recommend considering a Comprehensive Travel medical insurance plan, you can read more about things to consider when buying insurance for seniors

A reputable online marketplace for travel insurance, such as OnshoreKare, allows you to compare and purchase visitors’ insurance.

Conclusion

We hope this article has helped you gain an in-depth understanding of the comparison between the benefits provided by the three plans.

Travel Medical insurance policy is one of the top considerations when we travel and especially when we have family members visiting the USA.

Always travel under the cover of insurance!