Visitors Care Insurance Review, the Best-Selling Fixed Benefits International Travel Insurance

Visitors Care Insurance is an affordable fixed-benefit Plan meaning it offers fixed benefits as part of insurance coverage.

This is a very popular American visitors’ insurance plan offering medical coverage to international travelers visiting the United States.

Visitors Care travel medical insurance is one of the best-selling fixed-benefit travel insurance plans for parents visiting the USA.

Considering international travel medical insurance for your upcoming trip? Remember that domestic insurance may not provide coverage to the insured outside their home country.

Here are some features, Costs, and Benefits of Visitors’ Care Insurance for foreign nationals visiting the USA.

You can also consider Visitor Secure another very popular fixed benefit travel insurance plan.

Visitors Care Insurance is a Travel Medical Insurance plan for non-U.S. residents and non-US citizens visiting the USA.

Visitors Care Insurance offers fixed benefit medical coverage for unexpected illnesses & accidents up to the policy’s maximum coverage.

While in the United States, the travel insurance company pays up to the stated amount in the policy document for each covered treatment or service (eligible medical expenses) after the deductible is satisfactorily met.

Know the difference between a comprehensive coverage plan and a fixed benefit plan.

Visitors Care Insurance is a low-cost, affordable fixed benefit plan that provides medical benefits and coverage such as:

- Inpatient Medical Expenses

- Outpatient Medical Expenses

- Emergency Medical Evacuation

- Ambulance Transportation

- And more…

Features:

- Policy Maximum Options: $25,000, $50,000, $100,000

- Deductibles Options: $0, $50, $100

- Duration of Coverage: Minimum 5 days, maximum 2 years

- Medical Coverage for short-term visitors to the USA

Costs:

- More affordable when compared to comprehensive plans, but with correspondingly lesser coverage

- An extension fee may apply

Benefits (limits may apply):

- International Travelers seeking coverage can rely on this limited-coverage travel medical insurance plan

- Covers medical bills as per eligible expenses for in-patient and out-patient treatments, ambulance transportation, emergency evacuation, and more

- Covers visitors to the USA for a minimum of 5 days to a maximum of 2 years

- Offers COVID-19 Coverage benefits

- Provides emergency room coverage

- Offers Emergency Dental Accident Coverage

- Provides Acute onset of Pre-Existing Conditions Coverage

What is Visitors’ Insurance?

Travel Insurance is known as visitor insurance. It is also referred to as travel medical insurance and trip insurance. However, there are differences between travel medical insurance and trip insurance.

If you or your family members are traveling to the USA then you should consider a travel medical insurance plan as healthcare in the USA is very expensive. Travel Insurance can help save a serious financial impact in case of a medical emergency.

Medical emergencies can happen anytime to anyone at any time. It is always good to be prepared when traveling internationally and have travel insurance to cover any eventuality. Our visitors’ insurance guide can help you understand the visitors’ insurance for the USA more in-depth.

Visitors Care Insurance

Visitors Care Travel Insurance is a low-cost, Fixed benefit visitors insurance plan for international travelers to the USA. that provides medical benefits such as Inpatient and Outpatient Treatments, Emergency Evacuation, Ambulance transportation, and more

A.M. Best Rating: A

Insurance Company/Plan Administrator: IMG (International Medical Group)

Underwritten By: SiriusPoint Speciality Insurance Corporation

Coverage Type: Fixed Benefit Plan

Type of Insurance: International Travel Medical Insurance Plan

Eligibility: Non-US Residents and Non-US-Citizens visiting the USA

Medical Benefit Option: Up to $25,000, $50,000, or, $100,000

Area of Coverage: United States

Period of Coverage: 5 days up to 12 months (Renewable up to 24 months)

Period of Coverage per Injury of Illness:

- Ages 14 days to 79 years of age: $25,000

- Ages 80 years and Older: $10,000

Extendable: Yes (Up to 24 Months)

Cancelable: Yes

Pre-Existing Medical Conditions: Excluded

Acute Onset of Pre-Existing Conditions: Included

Terrorism Coverage: Covered (Maximum Limit $50,000)

COVID-19: Covered (same as any other illness)

Deductible Options: $0 to $100

Coinsurance: 100% of scheduled Benefit Plan

Policy Maximum Limits:

- Visitors Care Insurance plan- Lite: $$25,000

- Visitors Care Insurance plan – Plus: $50,000

- Visitors Care Insurance plan – Platinum: $1,00,000

Visitors Care Insurance comes in three types viz. Lite, Plus, and Platinum, the limits within each plan variant, differ.

Generate a free no obligation quoteto compare visitors’ insurance plans

Visitors Care Insurance Eligibility

This travel medical insurance plan can be bought by non-US residents and non-US citizens visiting the USA from a foreign country. It is short-term travel medical insurance with maximum coverage benefits for 12 continuous months.

- Must be at least 14 days old

- Must be less than 99 years of age

Visitors Care Insurance Highlights

- Deductible Options: From $0 to $100

- Maximum Limits: From $25,000 to $1,00,000

- Limited medical coverage for unexpected illnesses and accidents up to the listed maximum

- Renewable for up to 24 months

- COVID-19 covered the same as any other illness

Visitors Care Insurance Summary

Visitors’ care insurance offers a broad package of scheduled benefits for Non-U.S. residents traveling and/or temporarily residing outside of their home country.

Visitors Care offers coverage for a minimum of 5 days.

- Insurance Type: Travel Medical Insurance plan

- Period of Coverage: 5 days up to 12 months

- Renewable: Up to 24 months

- Maximum Limits:

- Lite: $25,000

- Plus: $50,000

- Platinum: $1,00,000

- IMG Member Account: 24/7 secure Access anytime from anywhere in the world (To manage account)

Visitors Care Plan Details

The area of coverage is United States for non-U.S. residents traveling to the U.S.

The period of coverage is from a minimum of 5 days up to 2 years

Visitors Care Insurance offers policy maximums per illness per injury:

- LITE: $25,000,

- PLUS: $50,000,

- PLATINUM: $100,000

The policy maximum is the maximum amount that the insurance company will cover for the policyholder as per the purchased plan

Unlike many other fixed coverage plans, the policy maximum is for the lifetime of the plan, instead of per incident

Deductible options are

- LITE: $0, $50, $100,

- PLUS: $0, $50, $100,

- PLATINUM: $0, $50, $100,

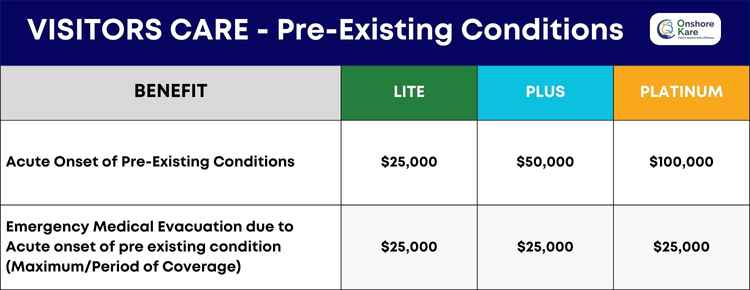

Pre-Existing Condition Coverage Benefits

The insurance plan offers pre-existing condition coverage for the Acute onset of pre-existing conditions:

- LITE: $25,000 (Maximum/coverage period – Subject to sub-limits)

- PLUS: $50,000 (Maximum/coverage period – Subject to sub-limits)

- PLATINUM: $100,000 (Maximum/coverage period – Subject to sub-limits)

Acute Onset of Pre-Existing Condition

The age of the insured person must be under 70 years. The maximum limit is $25,000.

If you are looking for pre-existing condition coverage details then this plan is not suitable and you can consider alternative plans.

Emergency Medical Evacuation

Emergency medical evacuation resulting due to covered acute onset of a pre-existing condition.

The age of the insured person must be under 70 years. The maximum limit is $25,000 per period of coverage

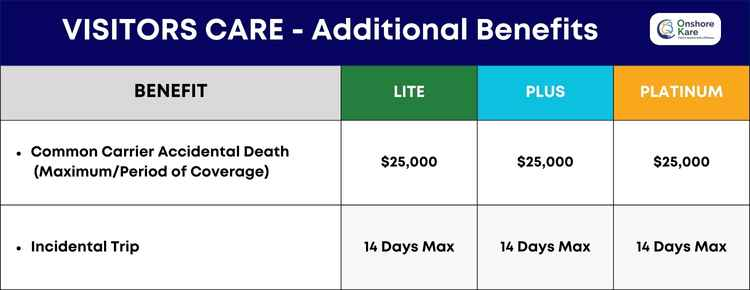

Visitors Care Insurance Additional Benefits

Common Carrier Accidental Death maximum $25,000 per period of coverage

Incidental Trip maximum 14 days provided the Insured person’s country of residence is not the U.S.

What is the difference between policy maximum and per-incident maximum

Policy maximum and per-incident maximum are two different terms used in insurance policies. Here are the differences between them:

Policy Maximum:

- The maximum amount that the insurance policy will pay for covered services or expenses

- It varies for every policy and can range from $10,000 to $8 million, depending on the age of the traveler

- It is one of the factors that affect the cost of visitors’ insurance

- The higher the policy maximum, the higher the premium will be

Per-Incident Maximum:

- The maximum amount an insurer will pay for a single event/claim

- It is a limit that can be applied to several coverage types

- For example, if you have $30,000/$60,000 coverage, the company will pay a maximum of $30,000 to each person who sustained damage in your accident

- It is different from policy maximum, which applies to the whole policy period

In summary, policy maximum is the maximum amount that the insurance policy will pay for covered services or expenses, while the per-incident maximum is the maximum amount an insurer will pay for a single event/claim

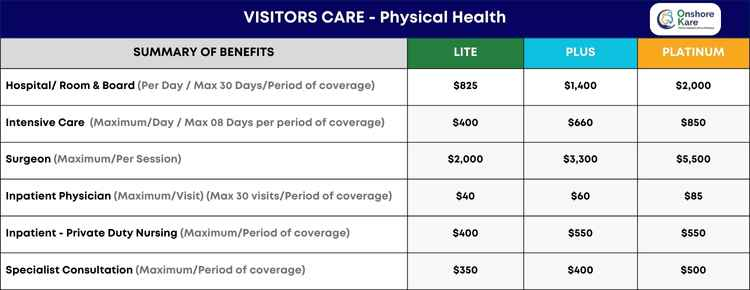

Visitors Care Insurance Medical Benefits

Intensive care: Inpatient – up to additional per day, Maximum 8 days per period of coverage

- LITE: $400

- PLUS:$660

- PLATINUM: $850

Physical Therapy – Medical order or treatment plan required. Per day visit, Maximum 12 visits/period of coverage

- LITE: $40

- PLUS: $40

- PLATINUM: $40

Pre-Admission Testing – Inpatient maximum per period of coverage

- LITE: $750

- PLUS: $1,000

- PLATINUM: #1,375

Anesthesia – Up to maximum, per surgical session

- LITE: $450

- PLUS: $825

- PLATINUM: $1,375

Extended Care Facility – For all three plans Lite, Plus, Platinum is covered under Hospital Room and Board when directly transferred from an acute care hospital

- LITE: Covered under hospital room and board

- PLUS: Covered under hospital room and board

- PLATINUM: Covered under hospital room and board

Hospital Room& Board – These are average semi-private room rates, It Includes nursing, Miscellaneous and ancillary charges.

(Inpatient) Up to max/day, Maximum Up to 30 days/period of coverage.

- LITE: $825

- PLUS: $1,400

- PLATINUM: $2,000

Prescriptions – Dispensing limit is 90 days,

Outpatient up to maximum per period of coverage

- LITE: $250

- PLUS: $250

- PLATINUM: $250

Hospital Emergency room, (Outpatient) Maximum per visit

- LITE: $200

- PLUS: $330

- PLATINUM: $550

Emergency Local Ambulance – Up to maximum per period of coverage

- LITE: $250

- PLUS: $450

- PLATINUM: $475

Physician Visits/Services: Maximum/visit, Maximum visits 30 per period of coverage:

- Outpatient-

- LITE: $40

- PLUS: $60

- PLATINUM: $85

- Inpatient

- LITE: $40

- PLUS: $60

- PLATINUM: $85

Assistant Surgeon – maximum per surgical session

- LITE: $450

- PLUS: $825

- PLATINUM: $1,375

Surgery both Inpatient and outpatient, Up to maximum per surgical session

- LITE: $2,000

- PLUS: $3,300

- PLATINUM: $5,500

Outpatient Surgical/Hospital Facility

Up to maximum per surgical session/Up to max per surgical session

- LITE: $2,000/$750

- PLUS: $3,300,/$900

- PLATINUM: $5,500,/$1,000

Radiology/X-ray – Laboratory

Outpatient: Up to maximum/period of coverage

- LITE: $400 ($200/Procedure)

- PLUS: $450 ($250/Procedure)

- PLATINUM: $500 ($500/Procedure)

Urgent Care – Maximum/visit, Maximum 10 visits

- LITE: $40

- PLUS: $60

- PLATINUM: $85

Chemotherapy/Radiation Therapy

- LITE: $550 (Maximum/visit)

- PLUS: $1,100 (Maximum/Visit)

- PLATINUM: $1,350 (Maximum/Visit)

Home Nursing Care – Upon direct transfer from an acute care hospital is provided by a home healthcare agency. Maximum/Period of coverage.

- LITE: $550

- PLUS: $550

- PLATINUM: $550

Durable Medical Equipment

- LITE: $550 (Maximum/Period of coverage)

- PLUS: $1,000 (Maximum/Period of coverage)

- PLATINUM: $1,300 (Maximum/Period of coverage)

COVID-19/SARS-Cov-2 Coverage

- LITE: Same as any other illness or injury

- PLUS: Same as any other illness or injury

- PLATINUM: Same as any other illness or injury

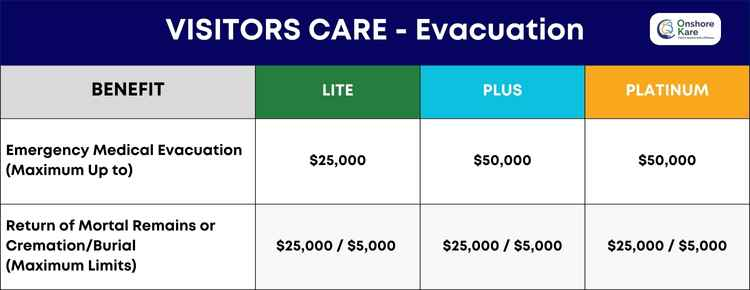

Visitors Care Medical Evacuation

Emergency Medical Evacuation Up to the Maximum Benefit of

- LITE: $25,000

- PLUS: $50,000

- PLATINUM: $50,000

The maximum Return of Mortal Remains for all three plans is $25,000, or/with a Maximum Cremation/Burial of $5,000 for all three plans.

- LITE: $25,000(Maximum) with $5,000 (Maximum) for Cremation/Burial

- PLUS: $25,000(Maximum) with $5,000 (Maximum) for Cremation/Burial

- PLATINUM: $25,000(Maximum) with $5,000 (Maximum) for Cremation/Burial

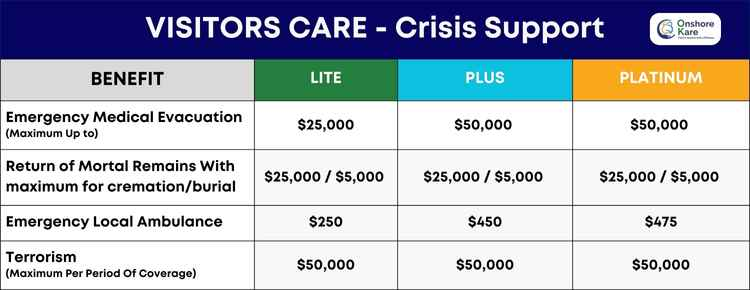

Visitors Care Insurance Trip Protection and Crisis support

Visitors Care insurance provides the following as trip protection and crisis support

Emergency Medical Evacuation:

- LITE: $25,000 (maximum)

- PLUS: $50,000 (maximum)

- PLATINUM: $50,000 (maximum)

Return of Mortal remains (maximum) with cremation/Burial

- LITE: $25,000 (maximum) with $5,000 for Cremation/Burial

- PLUS: $50,000 (maximum) with $5,000 for Cremation/Burial

- PLATINUM: $100,000 (maximum) with $5,000 for Cremation/Burial

Emergency Local Ambulance:

- LITE: Up to $250 (maximum/Period of coverage)

- PLUS: $450 (maximum/Period of coverage)

- PLATINUM: $475 (maximum/Period of coverage)

Terrorism:

- LITE: $50,000 (maximum/Period of coverage)

- PLUS: $50,000 (maximum/Period of coverage)

- PLATINUM: $50,000 (maximum/Period of coverage)

Frequently Asked Questions (FAQs)

Which travel insurance is best for Indian parents traveling to USA?

There are several travel insurance plans that are suitable for Indian parents traveling to the U.S., Here are some of the best options:

- Patriot America Plus Insurance

- Patriot Platinum Insurance

- Safe Travels USA – Cost Saver Insurance

- Atlas America

- Safe Travels USA Comprehensive

If your parents have pre-existing conditionsthen you may want to consider the following plans:

Can I buy visitors insurance for my parents in USA?

Yes, you can buy visitors insurance for your parents in the USA. While purchasing visitors’ insurance is not legally mandated, it is strongly advisable to get health insurance for parents visiting the USA due to the high cost of healthcare, especially for elderly parents who are more prone to sickness

Is Visitors Care travel insurance the best visitor insurance USA?

Visitors Care is amongst one of the best travel insurance plans for the USA and is very popular.

Other top visitors insurance plans for the USA include:

- Safe Travels USA Comprehensive plan

- CoverAmerica-Gold

- Atlas America

- Patriot America Plus

- VisitorSecure

How Much Does Visitor Health Insurance Cost?

The cost of visitor health insurance in the USA varies depending on several factors such as the age of the traveler, the length of their trip, and their health needs

The typical cost of travel medical insurance is between $200 and $400

However, the cost of visitor health insurance can start as low as $1 a day, depending on the plan and coverage

The average cost of USA travel insurance starts from $16 per month

The cost of visitor health insurance plans can range from $5 per week for minimum coverage to over $100 per week for the best option available

The health insurance plans cost more depending on the age of the travelers

The cost of visitor health insurance will be lower if you choose a lower maximum limit for coverage

Conclusion

Visitors Care Insurance has gained significant popularity as a fixed-benefit health insurance option for visitors to the USA.

Fixed benefits health insurance plans like Visitors Care Insurance offer specific predetermined amounts for various medical services, providing a level of financial protection for visitors in case of unexpected medical expenses. These plans typically have lower premiums compared to comprehensive health insurance options.

However, it’s crucial to note that fixed benefits plans have certain limitations. They may not cover pre-existing conditions, or preventive care, or offer the same level of coverage as comprehensive plans. It’s essential to carefully review the policy’s terms, conditions, and exclusions to understand its coverage and limitations.

Remember, everyone’s health insurance needs may vary, so it’s essential to choose a plan that aligns with your specific requirements and budget.