Top 5 Reasons To Get Trip Cancellation Insurance For Any Reason

Travel is very unpredictable these days. From the time you make the initial trip deposit to actually boarding the flight, a lot can happen.

You dreamt of vacation and also went a little overboard with the total trip cost for your vacation! It happens with all of us, we want the best experiences on our vacation!

You had planned a nice family trip and somehow need to cancel the plans OR you had taken leave to go on holiday but your boss says there is a critical project that needs your help and you may need to cancel your plans.

Your scheduled departure date is not too far, what do you do in such circumstances? Your Trip Cost may burn a significant hole in your pocket depending on your travel destination country.

As we all know there are always non-refundable trip costs involved if you cancel your trip.

Whatever the reason, Trip Cancellation Insurance can be of help. CFAR or Cancel for Any Reason Travel Insurance can cover the financial impact of your trip cost in case you were to cancel.

Let’s dive deeper into Cancel For Any Reason – CFAR Travel Insurance so that it helps you when you are planning your next trip.

5 Reasons to buy CFAR Coverage as an Add-On to Tavel Insurance

1. CFAR Coverage is a great way to protect your trip cost for an upcoming trip.

2. CFAR Coverage can protect you from unforeseen circumstances that cause you to cancel your plans, like illness, injury, or for any other reason.

3. CFAR Coverage can also be useful if there’s a change in circumstance that makes it impossible for you to travel, like an unexpected layoff or important meetings at the office.

4. CFAR Coverage will cover you for any reason—even if the weather is bad where you’re going! If a storm hits and ruins your vacation plans, CFAR Travel Insurance will help you get reimbursed for trip costs as a result of canceling early.

5. To purchase CFAR coverage is easy! There are no additional forms to fill out—just add the option online when you are buying travel insurance. Ensure you buy it within the stipulated time after the initial trip deposit as defined in the insurance plan.

We always recommend you read the policy document carefully and see the inclusions and exclusions in the policy and if CFAR Coverage is available as an add-on. Not all plans provide this. If available it is advisable to purchase CFAR coverage.

What is Cancel for Any Reason Travel Insurance Coverage – CFAR Coverage?

If you have to cancel a trip, travel insurance can help you get your money back, but only if you cancel for certain reasons. CFAR Insurance mitigates this risk for limited reasons.

Cancel For Any Reason – CFAR insurance may be what you need if you want more freedom. Travel insurance with the add-on of “cancel for any reason” cover means just that.

You can change your mind, no matter why, and get a significant part of the non-refundable trip cost paid back.

You don’t have to worry about meeting the requirements for Cancel For Any Reason – CFAR travel insurance coverage.

Your CFAR Travel Insurance will save your financial loss i.e. non refundable trip costs.

Remember that you have to buy Cancel For Any Reason – a CFAR travel insurance add-on within a specified period of your initial trip payment.

The time frame could vary from 10 – 21 days from the initial trip payment or initial trip deposit.

You need to however ensure that if you cancel for any reason your trip cancellation should be 48-72 hours prior to your scheduled departure date or as defined by the trip insurance plan.

The most important things to know about travel insurance that lets you cancel for any reason are:

- Cancel for Any Reason – CFAR travel insurance is extra coverage that lets you get a significant sum of your money back if you have to cancel a nonrefundable trip for a reason not covered by your travel insurance.

- The reimbursement on non-refundable trip costs can be in the range of 50 to 70 percent, it depends on the plan limits. you also need to cancel before the stipulated time period from your departure date.

- You can’t just buy Cancel for Any Reason – CFAR travel insurance by itself. It is an upgrade that you can choose to get when you buy your main travel insurance.

- Not all travel insurance companies offer to Cancel for Any Reason – CFAR travel insurance on all their plans.

- Cancel for Any Reason – CFAR travel insurance is the only kind of insurance that will pay you back if you have to cancel your trip for any reason.

- You can buy Cancel for any reason coverage up to 21 days after you make the initial trip payment, the number of days varies as per plans, read the terms for the plan you intend to buy.

Will CFAR Travel Insurance reimburse my whole Trip Cost?

No. In case of trip cancellation in Cancel for Any Reason – CFAR coverage usually covers partial reimbursement and could be as high as a 75% refund on the non-refundable trip costs that have already been paid for.

Please do note that the covered percentage could vary between 50% to 75% and is insurance plan specific.

Always read the insurance plan terms in detail to understand how much will it reimburse in case of Cancel For Any Reason. Travel Insurance Companies provide a description of coverage in the policy document.

CFAR gives you peace of mind if you’re having second thoughts about a trip you’re planning and think you might have to cancel it.

You need to buy coverage within 10-21days from the initial trip deposit to protect your trip cost due to cancellation.

Cancel for Any Reason Insurance is an essential part of the travel insurance because it can protect you from financial loss in the event that you need to cancel your trip.

Cancel for Any Reason insurance is an essential part of the travel insurance because it covers you in the event that you need to cancel your trip due to reasons beyond your control.

If, for example, you get sick and can’t make the trip, or if natural disasters force you to cancel your travel plans, You’ll be covered.

Can I really cancel ANYTHING? What is covered by a CFAR policy?

Yes, for anything. When you buy CFAR coverage, you can cancel your trip for any reason you want without worrying that you’ll lose your entire non-refundable vacation deposit.

It doesn’t matter why you have to cancel as long as you do it within the allowed time frame, which is usually two days (48 – 72 hours) in advance of your scheduled departure date, and you have insurance to cover the entire cost of your trip that you can’t get back.

Sample Reasons that are covered by Cancel for Any Reason Travel Insurance

- You changed your mind due to other priorities

- Travel Documents Not Available

- Family Reasons

- Epidemic

- Pandemic

- Work Reasons prohibiting you from travel

- Weather Conditions

- Other Reasons

Are there any Limitations of Cancel for Any Reason – CFAR Insurance?

There are a few things that CFAR travel insurance can’t do:

- It doesn’t pay back everything. Reimbursement percentages vary from 50% to 75% depending on the policy.

- You can’t just stop going on a trip at the last minute. To get your money back, you must cancel at least 48 to 72 hours two days before the scheduled departure date.

- You must buy coverage for 100% of your nonrefundable trip costs; you can’t pick and choose which parts you want to cover.

- After buying a nonrefundable trip, you have between 10 and 21 days (depending on the policy) to add the cancel for any reason (CFAR) option.

- Taking vouchers or credits from airlines can change how much you can claim. If you take a voucher, you can’t use your travel insurance to pay for that cost. But if you only get partial credit for the trip or have expenses that haven’t been paid back yet, you can ask for the rest.

What’s the difference between Cancel for Any Reason Travel Insurance and Regular Travel Insurance?

If you cancel a trip and submit a trip cancellation claim, you can get money back for canceled travel is limited by most types of travel insurance.

Under some travel insurance plans, there are also other valid reasons, such as:

- Terrorist attack

- Natural calamities/disasters

- The airline went bankrupt

Most of the time, travel insurance won’t help if you cancel your trip because you’re afraid you’ll get sick. As the coronavirus began to spread in 2020, many people learned that they can’t just cancel and be reimbursed.

Most of the time, the only way to get a partial refund on a pre-paid, non-refundable trip is to buy CFAR coverage.

Every policy is different, so you’ll have to read the fine print to find out what’s covered and what isn’t, especially if you need to cancel your trip.

If you have regular travel insurance you need to check if the plan offers optional cancel benefits that you can add at an additional cost.

Cancel For Any Reason Travel Insurance Impact on Travel Insurance Cost

Cancel for Any Reason coverage will probably add about 50 percent to the total cost of your travel insurance.

The U.S. Travel Insurance Association (USTIA) says that a full travel insurance policy usually costs between 4 and 8 percent of the total trip cost.

Based on these numbers, CFAR coverage plus travel insurance will cost you between 6 and 12 percent of the total cost of your trip.

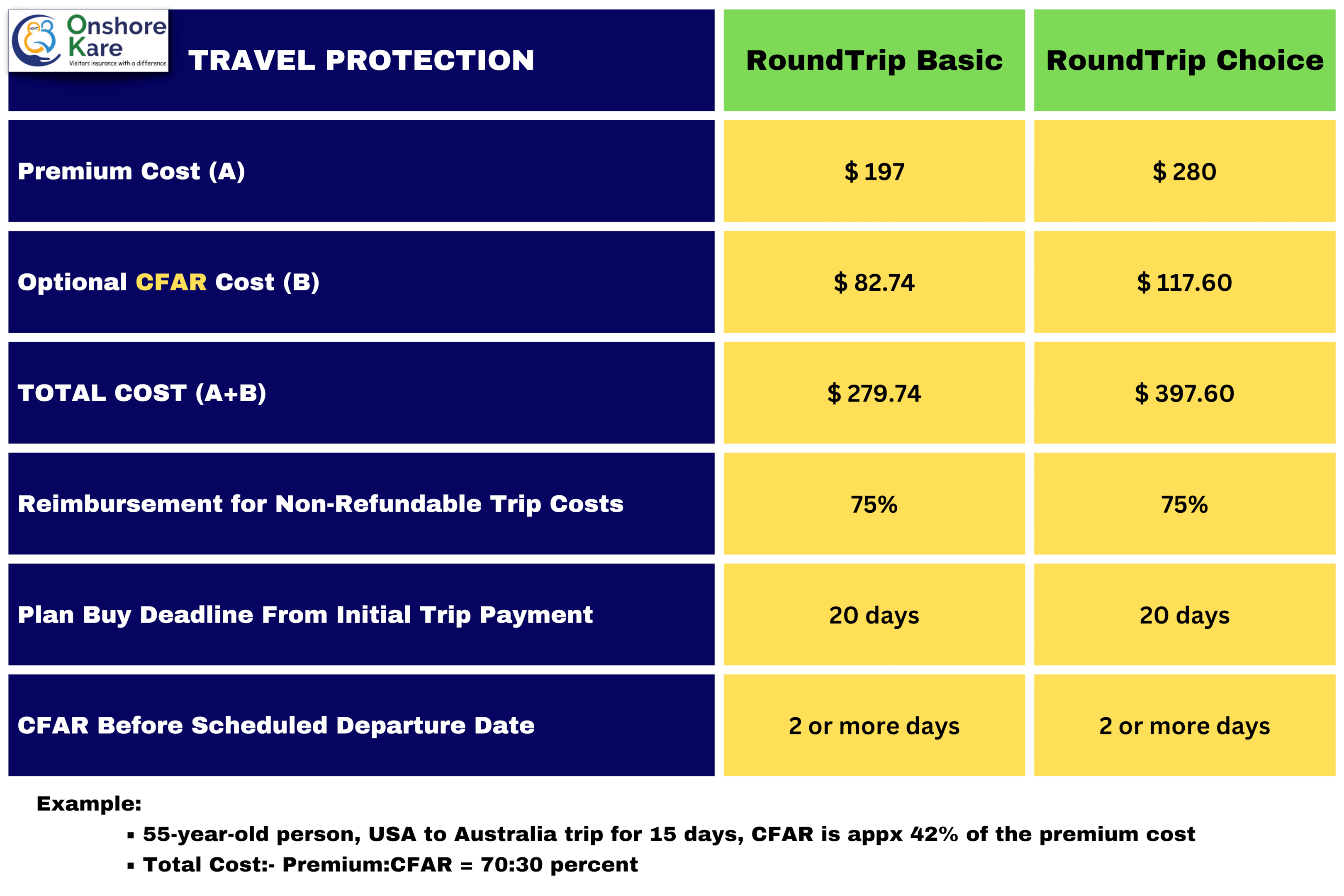

Let us look at an example of the RoundTrip Travel Protection plan from Seven Corners Travel Insurance

In the example shown above the cost impact of Cancel For Any Reason Coverage is 30% of the total premium amount for both RoundTrip Basic Trip Insurance and RoundTrip Choice Trip Insurance.

We have covered Seven Corners Travel Insurance Plans in detail, you can read more about it here.

When should you buy CFAR insurance coverage?

Most trip insurance companies have limits on how long you have to buy CFAR coverage. This add-on must be bought between 10 and 21 days after the first trip payment, please note that the time frame may vary depending on the insurance provider.

It is always good to check the insurance companies’ trip cancellation insurance for any reason coverage details in their policy brochure or policy document.

Do All Insurance Providers offer CFAR coverage?

CFAR is not provided by all insurance companies, you should inquire about its availability before making a purchase from a provider, insurance agents, or online insurance marketplaces that sell insurance directly to customers.

Please check if CFAR – Cancel For Any Reason Check if the plan you propose to buy has CFAR coverage, especially in light of the COVID-19 pandemic.

How to purchase Cancel for Any Reason Insurance?

Cancel for Any Reason Insurance is a type of travel insurance that allows you to cancel your trip or tour without a financial penalty, even if you have to cancel because of something unexpected.

You can purchase Cancel for Any Reason Insurance at the time you buy your flight or vacation. If you want to make sure you have this protection before booking your trip, contact your travel agent or insurer directly and ask whether they offer to Cancel for Any Reason Insurance.

If you’re purchasing a travel insurance policy through a third party, such as an online travel agency, it’s important to check that the policy covers Cancellation by You (also known as “cancel for any reason”) before purchasing the travel insurance plan before making your initial trip payment.

If you have already given an initial trip deposit or paid in full your trip cost but didn’t buy trip insurance, you can still buy CFAR from an insurance company directly or through an online travel insurance marketplace. Remember to buy trip insurance as soon as you can from your initial trip payment date.

What is the Significance of “Initial Trip Payment” OR “Initial Trip Deposit” in CFAR Coverage?

As highlighted earlier in this article, the trip cancellation coverage has a time frame within which you need to buy this Add-On CFAR coverage.

Usually, the duration is within 10-21days from the initial trip payment or initial trip deposit date. The number of days can vary depending on the trip cancellation insurance policy terms.

We are referring to the Trip Cancellation Coverage that extends you the option to cancel the trip for any reason. This is different from the limited cancellation terms in the policy.

“Cancel For Any Reason” Trip Cancellation Coverage FAQ

I want to cancel my trip but I don’t have Cancel for any reason (CFAR) Coverage. What Can I do?

If you want to go ahead with trip cancellation and don’t have Cancel for Any Reason coverage then you can cancel it for one of the reasons listed in the policy document.

Your request will be processed as per the policy description by the insurance provider.

Some of the common reasons acceptable for trip cancellation are natural disasters, terrorist attacks at the destination you are headed to, or if you have suffered an injury before your trip could begin.

There are other family-based reasons as well like being present for the birth of a family member’s child. Read the policy document to understand the acceptable reason for trip cancellation.

How does Trip Insurance work?

Trip Insurance protects your financial expense on Trip Costs and extends benefits like trip cancellation insurance coverage if you add Cancel for Any Reason Coverage to the plan.

Standard cancellation reasons are listed in the policy document but due to so many uncertainties existing around travel, the CFAR coverage can help. We have covered Trip Insurance in detail, you can read more about it.

Is Travel Medical Insurance different from Trip Insurance, can I add Cancel for any reason coverage to my travel medical insurance plan?

There are differences between Trip Insurance coverage plans and Travel Medical Insurance Coverage plans.

Trip Insurance is designed to protect your trip cost right from the time you make the initial trip payment (coverage starts from the time you buy the trip insurance).

While Travel Medical Insurance coverage is designed to protect you from unforeseen medical expenses.

Both types of insurance policies overlap in the benefits they provide in many areas and there are differences based on the core objective of why these plans are designed.

Can I buy CFAR insurance with Travel Medical Insurance for my parents visiting the USA?

Trip Cancellation Coverage as an add-on option is to protect your trip cost and is usually an add-on feature in Trip Insurance policies. This add-on is, cancel for any reason.

Comprehensive Travel Insurance plans have trip delay & interruption usually built into the plans, they usually may have a trip cancellation due to reasons like terrorist attacks, natural disasters, etc.

Some plans may offer CFAR coverage, need to read the policy terms to ensure the coverage is available or not. The Patriot Series comprehensive travel insurance plans from IMG for example offer an optional cancel for any reason coverage in their plans but only to U.S. Residents.

My Trip Scheduled Departure Date is tomorrow, can I buy CFAR Insurance because I need to cancel my travel?

There are conditions to availing a Cancel For Any Reason Coverage, the purchase of this coverage has to be within a stipulated time frame from the initial trip payment and the trip cancellation needs to be 48-72 hours prior to the scheduled departure date.

In this case, the CFAR coverage will not be useful. Please note that the terms and days & hours restrictions may vary in different plans, always refer to the plan document for details.

Conclusion

The coronavirus has had a substantial effect on past and future travel. Many individuals and families have been forced to postpone travel, and many are cautious to schedule future holidays.

Although normal travel insurance can protect you in the event of unforeseen events before or during your trip, it comes with a number of restrictions and exclusions.

If your departure date is far and you are unsure about the trip then CFAR coverage is a great option to protect your pre-paid trip costs.

The easiest method to secure a nonrefundable trip is to purchase the optional Cancel For Any Reason – CFAR Coverage, which allows you to cancel for any reason and still receive a substantial refund.

Travel Safe!