CoverAmerica Gold vs Safe Travels USA Comprehensive Insurance Plans Comparison

CoverAmerica Gold vs Safe Travels USA Comprehensive travel insurance comparison will help you decide which is a better plan for your needs.

Visitors insurance is one of those things you don’t realize you need until you need it. If you find yourself in a scenario where you could need travel medical insurance, also known as visitor insurance, you must have a comprehensive medical coverage plan in place.

If you are thinking about visiting the United States, two of the most popular visitor insurance plans are CoverAmerica Gold and Safe Travels USA Insurance.

Healthcare costs in the United States are extremely high, and insurance protects you against unforeseen medical emergencies.

These visitor insurance plans contain several features and/or restrictions that make them more suitable for overseas travelers and parents visiting the USA.

Key Highlights: CoverAmerica Gold vs. Safe Travels USA Travel Medical Insurance Plans

Even though there are several visitor insurance plans available, CoverAmerica Gold and Safe Travels USA are two of the best travel insurance policies for US travelers.

Both are well-known, all-inclusive foreign travel medical insurance plans with an excellent track record. Both plans include COVID-19.

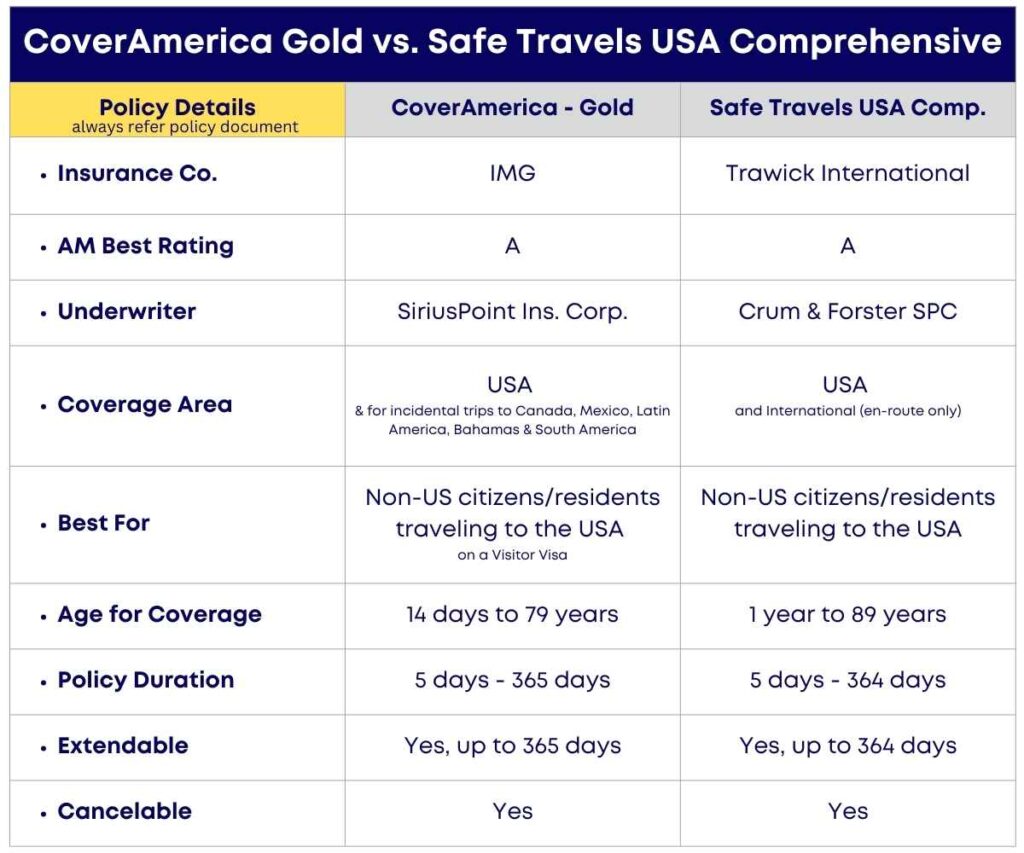

Despite their many similarities, these two plans have significant differences. The comparison chart below can help you choose the right plan for your needs.

Let’s look at the similarities and differences of each travel medical insurance plan.

About CoverAmerica Gold Comprehensive Travel Health Insurance

The CoverAmerica – Gold travel insurance plan offers Comprehensive Travel Medical Insurance. It provides adequate coverage to the insured both within the US and for overseas travel from the US to selected foreign nations.

This insurance offers a wide range of features that make it the best alternative for travelers needing comprehensive medical coverage while traveling to the US.

Insurance from CoverAmerica Gold offers protection from passport loss, border entry protection, missed flights return flights, and many more.

Pre-existing condition coverage is a major worry for parents who vacation abroad. The comprehensive benefits package of this plan includes coverage for acute onset of pre-existing conditions.

The plan covers medical expenses in the event of a new illness or injury, as well as any other eligible incident. This is a well-known travel medical insurance plan.

- Watch our YouTube video on Top 10 benefits of CoverAmerica Gold

- Watch our YouTube video on 10 Reasons to Buy Safe Travels USA Comprehensive

About Safe Travels USA Comprehensive Insurance Medical Expenses

The Safe Travels USA Plan is a short-term health insurance plan for international travelers traveling to the United States and other destinations on their itinerary.

It is one of the few comprehensive insurance policies that provides a $50,000 policy maximum to people aged 80 and above.

As a First Health PPO Network member, you have access to a network of doctors, hospitals, urgent care centers, labs, and other healthcare providers.

This plan provides comprehensive medical coverage to non-citizens of the United States who live outside the country and are visiting the United States or other countries.

It is not available to US citizens with green cards or those aged 90 or older.

Initial coverage is available for a minimum of five (5) days and a maximum of 364 days. If a minimum of 5 days is purchased, coverage may be extended for a maximum of 364 days.

Read our travel insurance reviews on each of these plans:

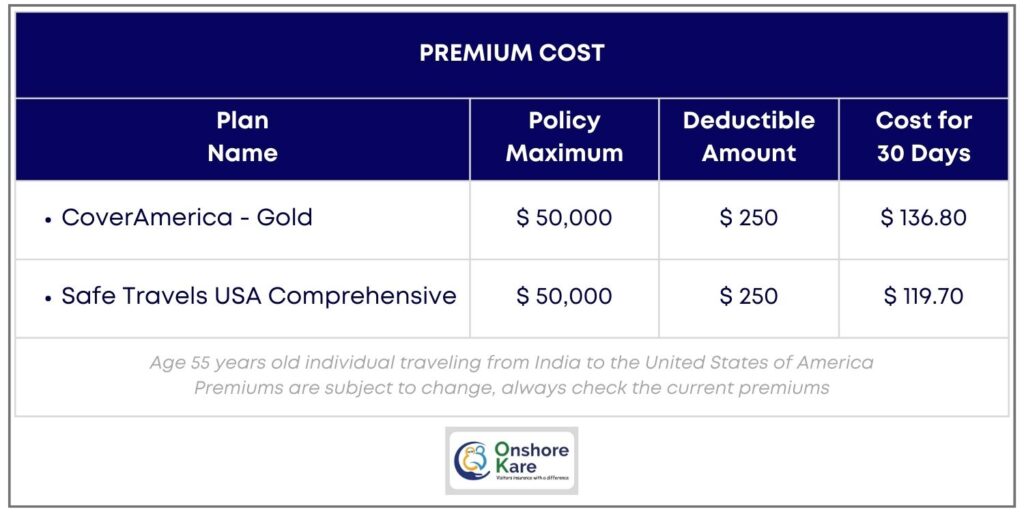

How much do the plans cost?

When compared to other comparable comprehensive coverage plans:

These plans are priced quite reasonably. Consider the following premium differences between CoverAmerica Gold vs. Safe Travels USA insurance plans:

The premium for the same terms for Patriot America Plus and Atlas America Insurance, two other highly popular visitors’ insurance plans:

- Patriot America Plus would be $120.90

- Atlas America insurance would be $130.80

Please note that premiums are subject to change depending on several factors and the insurance providers may also make changes to plan premiums.

Get a Free, No-Obligation travel insurance quote to see the current prices.

COVID-19 Coverage

As far as COVID-19 is concerned there is not much of a difference between CoverAmerica Gold vs Safe Travels USA Comprehensive.

CoverAmerica Gold Comprehensive travel insurance covers COVID-related medical expenses as well as treatment for any other illness/sickness as defined by the policy terms.

According to the policy’s terms, Safe Travels USA Comprehensive travel insurance also covers COVID-19-related costs as well as other medical benefits.

If COVID-19 was contracted before the policy’s effective date, the plan will not cover COVID-19. The insured person is covered for COVID-19 by both travel medical insurance plans during the policy period.

Pre-Existing Conditions Cover – CoverAmerica Gold vs Safe Travels USA Comprehensive

These travel health insurance plans extend Acute Onset of Pre-Existing Condition Coverage.

Acute onset of pre-existing conditions is an important factor to consider if you have parents visiting the United States and are looking for travel insurance that covers pre-existing conditions.

Most travel medical insurance policies are not intended to cover pre-existing conditions, but rather to cover emergency medical expenses while abroad.

If you need Travel Insurance that covers Pre-existing Conditions, consider the following plans:

Note: Hop Plans are travel assistance plans and not travel insurance plans.

For ages up to 70 years, CoverAmerica Gold travel medical insurance coverage of Acute a Pre-Existing Conditions is up to the policy’s maximum coverage. For those over the age of 70, acute onset of pre-existing conditions coverage is available up to $30,000.

Acute and Pre-Existing Conditions are covered by Safe Travels USA Comprehensive. Except for heart disease or cardiac problems, which are limited to $25,000 for ages 69-70 and $15,000 for ages 70 and up, the maximum is up to the Medical Policy Maximum purchased per Period of Coverage for ages up to 69.

At the age of 70, the plan will reduce Acute Onset benefits to $35,000, with a lifetime of $25,000 for Emergency Medical Evacuation

What is an Acute Onset of Pre-Existing Conditions?

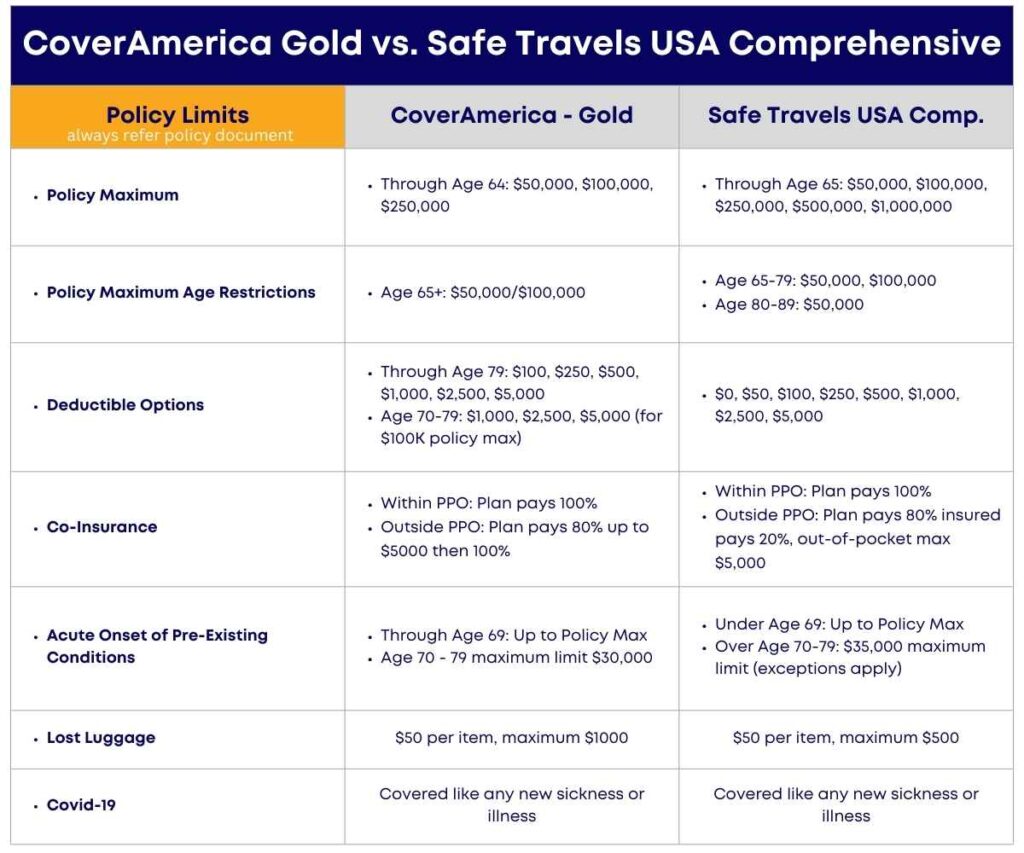

Policy Maximum:

Policy maximum coverage comparison of these comprehensive coverage plans:

- CoverAmerica Gold Policy Maximum Limit: $ 250,000

- Safe Travels USA Comprehensive Policy maximum limit: $ 1,000,000

Safe Travels USA provides a 4 times higher option as a max coverage option under its travel medical insurance policy.

CoverAmerica Gold travel medical insurance policy offers 3 options on a policy maximum

- Option 1. Policy Maximum of $50,000

- Option 2: Policy Maximum of $100,000

- Option 3: Policy Maximum of $250,000

The policy maximum for Senior Travelers is much less.

- Insurance policy maximum coverage for Age 65 and older: $50,000 or $100,000

Safe Travels USA comprehensive insurance plan offers 5 options on a policy maximum

- Option 1. $50,000

- Option 2: $100,000

- Option 3: $250,000

- Option 4: $500,000

- Option 5: $1,000,000

The limit for Senior travelers is much less.

- Age 80 to 89: $50,000

- Age 65 to 79: $50,000, $100,000

Safe Travels USA offers a broader range of coverage options and higher policy maximum limits. How does this benefit the insured? A higher policy maximum limit coverage means that the plan will pay for treatment up to the amount or limits specified in the policy terms.

Other Coverages

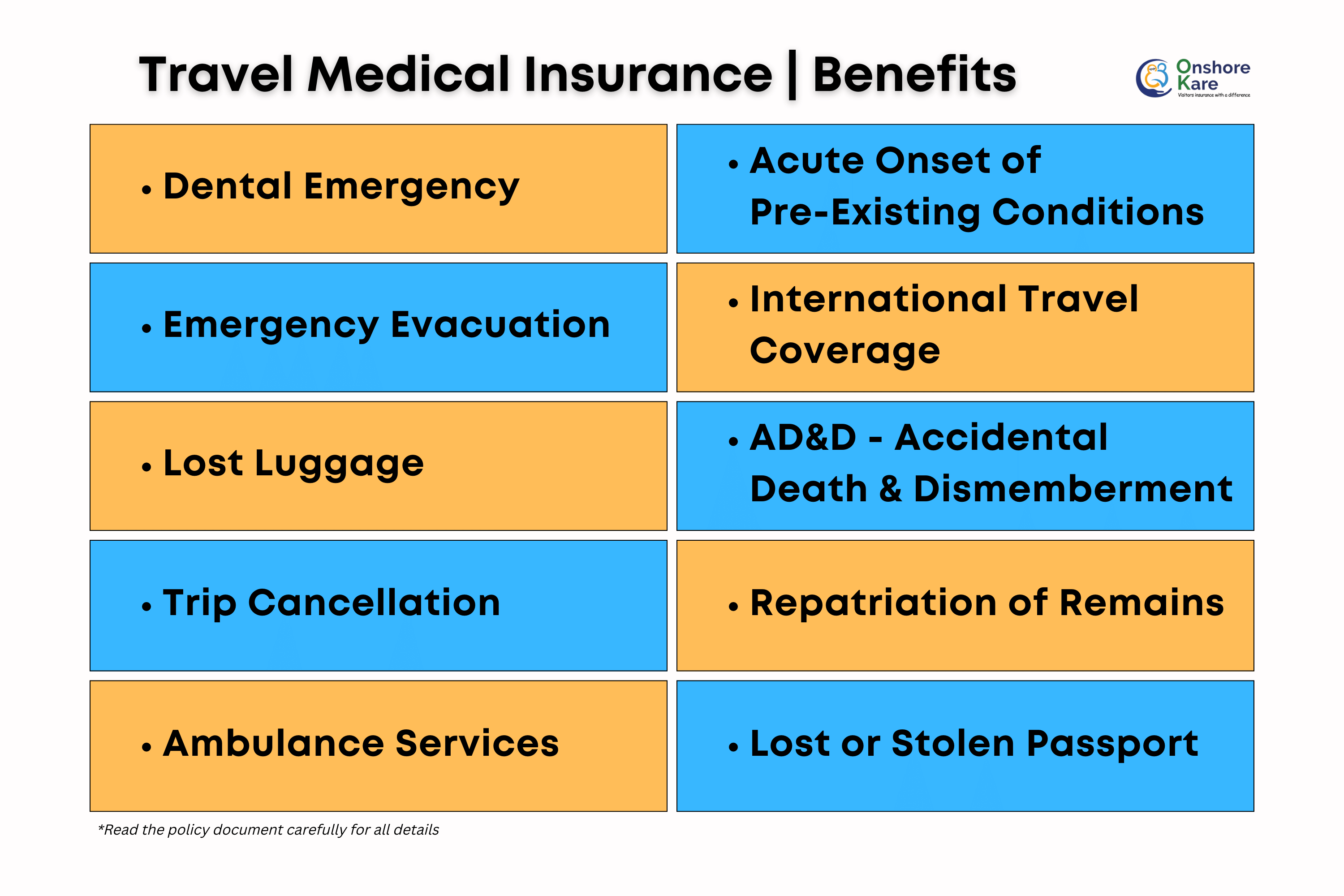

A travel health insurance plan covers any covered disease or injury as qualified medical expenses. Any incident defined as covered by the policy document will also be paid for or reimbursed to you by the terms and conditions of the policy document.

Let’s get a bird’s-eye view of the coverage: Coverage limits for CoverAmerica Gold vs. Safe Travels USA travel health insurance:

Safe Travels Cost Saver Visitors Insurance plan

- Visitors to the United States are covered by the Safe Travels USA Cost Saver Insurance, a comprehensive insurance program that covers them up to the age of 89.

- It is supplemental health insurance that includes all of the options provided by Safe Travels Medical Insurance and coordinates and pays for medical expenses not covered by the primary health plan, such as medical evacuation, co-insurance, and deductibles.

- Safe Travels USA Cost Saver Insurance is extremely popular among the 80+ age group because it provides a policy maximum of $50,000 for this age group.

Other Coverage for CoverAmerica Gold insurance plan

Emergency Public Health Screening

The insured beneficiary may be qualified for a free first health screening for a public health emergency if he has had a CoverAmerica Gold policy for at least 30 days.

Emergency Medical Consultations

A $15 co-payment is required for an urgent care consultation. After the deductible is met, the plan will pay 100% for any additional urgent care treatments provided within the network.

Preferred Rates for Regular Clients

Customers who make a repeat purchase receive a preferred pricing that is about 5% less than the original. As long as the original CoverAmerica-Gold insurance was purchased which is administered by IMG, the lower premium also applies to policyholders purchasing a new plan, renewals, and extensions. The policyholder’s first and last names must coincide with those entered when the insurance was first issued.

Emergency dental care and eye exams

The plan covers Acute, spontaneous, and unforeseen dental care associated with an accident up to $250. The insurance plan covers an urgent eye examination up to a maximum of 80%. The deductible and coinsurance are subject to the emergency eye test to pay for hospitalization due to an eye-related accident.

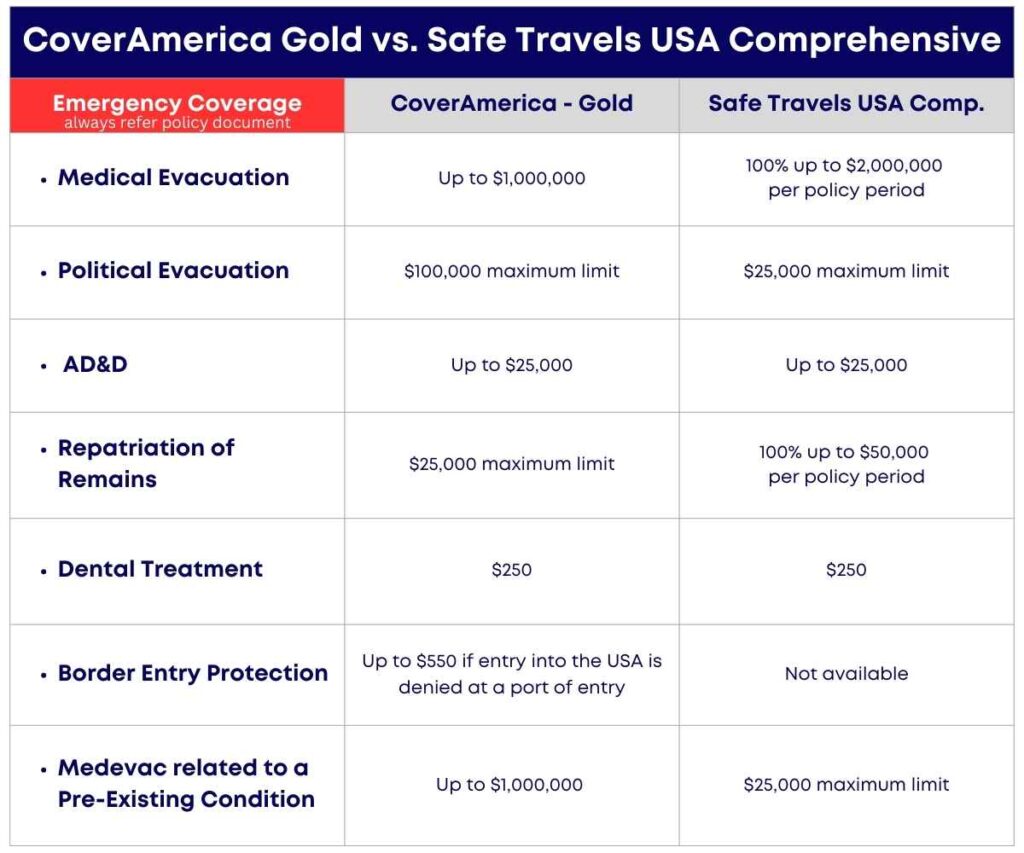

Border Entry Protection

If the insured, who is entering the US on a valid B2 visa, gets turned away at the border, the plan covers up to $550 in flight or carrier change fees.

The plan also includes coverage for recreational activities like theme park visits and sporting events, as well as coverage for terrorism and natural disasters, as well as the return of mortal remains, and political evacuation.

Cancelable and Renewal without Additional Fee

While most other plans impose a price ranging from $20 to $55 for any valid extensions, renewals, or cancellations, CoverAmerica Gold can be done at no extra cost to you.

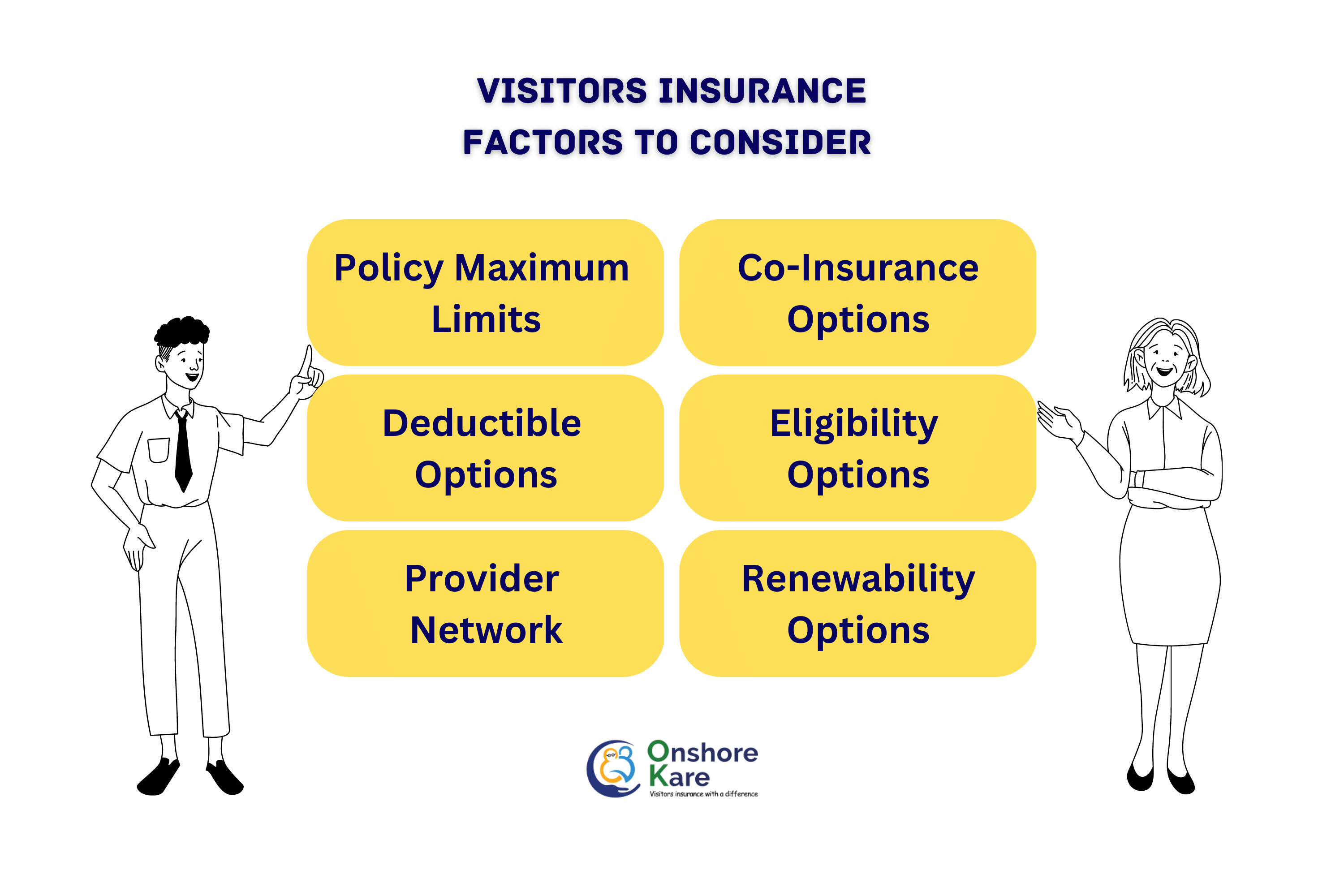

Factors to consider while comparing travel insurance plans

Insurance maximum limit between CoverAmerica Gold and Safe Travels USA Comprehensive:

This represents the maximum coverage of medical expense coverage the plan would provide. Safe Travels USA Comprehensive Insurance offers maximum coverage of up to $1,000,000 and CoverAmerica Gold Insurance tops it at $250,000 maximum coverage.

For elderly travelers, lower coverage limits may apply in both plans.

Deductible options between CoverAmerica Gold and Safe Travels USA Comprehensive:

This is the initial sum that the traveler must pay before their insurance will begin to reimburse them. Keep in mind that a plan with a greater deductible has a lower premium. There are various deductible options available for travelers to choose from with both CoverAmerica Gold and Safe Travels USA Comprehensive insurance. Both Safe Travels USA Comprehensive insurance and CoverAmerica Gold offer a range of deductible options from $0 to $5,000.

PPO Network for CoverAmerica Gold and Safe Travels USA Comprehensive insurance:

Both plans extend the PPO Network of health providers. Insurance companies create PPO networks to keep healthcare expenses under control. PPO stands for Preferred Provider Organization:

- CoverAmerica Gold – United Healthcare PPO Network

- Safe Travels USA Comprehensive – First Health PPO Network

If a member of the insured is admitted to a hospital or healthcare facility inside the provider network, the insurance plan will cover 100% of the eligible medical costs.

Coinsurance options for CoverAmerica Gold and Safe Travels USA insurance:

This represents a portion of the cost that the trip is responsible for. There are some limitations on coverage outside of the provider network for CoverAmerica Gold and Safe Travels USA Comprehensive. Both the plans cover 80% outside the provider network and it pays 100% inside the provider network.

Renewability options for CoverAmerica Gold and Safe Travels USA insurance:

Sometimes, travel plans can alter, requiring the extension of a US visitor’s stay. The renewal period for CoverAmerica Gold Insurance is two years. You can extend Safe Travels USA Comprehensive Insurance for one year.

Eligibility options of US visitors travel insurance for CoverAmerica Gold insurance and Safe Travels USA Comprehensive insurance:

Both of these comprehensive coverage plans provide complete medical coverage for unexpected medical emergencies to non-US citizens who are temporarily visiting the US.

Benefits of the plans being under specialist travel insurance companies

Cover America Gold – International Medical Group (IMG)

IMG Travel Insurance is one of the reputed and leading visitor insurance providers based out of Indianapolis.

International Medical Group (IMG) is a provider of global health and travel insurance. The company offers a range of insurance products and services for individuals, families, and businesses, including travel medical insurance, international health insurance, and emergency assistance services.

IMG provides coverage for individuals traveling abroad, as well as expatriates living and working in other countries. The company has a network of providers and medical facilities around the world and offers 24/7 access to assistance services.

Some of the benefits of plans offered by International Medical Group are:

- Comprehensive plans offer coverage and access to a wide PPO Network

- They offer customer assistance and service so you can always have access when you need

- IMG offers a wide variety of travel health insurance plans for every need

Check out our complete coverage of IMG Travel Insurance

Safe Travels USA – Trawick International

Trawick International, founded in 1998, offers a wide range of insurance solutions to travelers from all over the world. They are constantly looking for new ways to meet the needs of visitors from all over the world.

Trawick International specializes in international travel medical insurance and international student health insurance.

The following are some of the benefits of Trawick International’s plans:

- They provide medical expenses coverage, emergency medical evacuation, emergency medical treatment, repatriation, emergency reunion, security/political evacuation, and much more to anyone traveling outside of their home country.

- Trawick International has access to a vast global network of top-tier medical facilities, hospitals, and pharmacies, both domestically and internationally.

For foreign visitors who are 80 years of age and over, Safe Travels USA Insurance is the best health insurance option. Trawick International, a well-known US & international travel insurance provider, manages this complete coverage plan.

The first $1000 of covered expenses under the Safe Travels USA Insurance plan will be paid for the unexpected recurrence of pre-existing medical conditions.

Although there are limited coverage plans available, it is best to select a comprehensive plan because it will provide you with superior protection for the duration of your entire trip. Within the network of the preferred provider organization, the insurance plan pays the full policy maximum.

We have also covered Trawick International in detail.

What are the benefits provided by the comprehensive coverage of visitor medical insurance?

Frequently Asked Questions:

CAN I BUY COVERAMERICA GOLD FOR MY PARENTS VISITING THE USA?

Yes, you can buy CoverAmerica Gold for your parents visiting the USA. It is a popular & amongst the best visitor insurance plans. See our CoverAmerica – Gold Review.

IS IMG A REPUTABLE TRAVEL INSURANCE PROVIDER?

International Medical Group (IMG) specializes in International Travel Insurance plans and is highly reputed, read more about is IMG Travel Insurance worth it.

Since 1990, the International Medical Group (IMG) has offered travel insurance packages. IMG headquartered in Indianapolis in the state of Indiana in the USA has a workforce of over 300 employees. They cater to the travel insurance needs of individuals, groups, and business travelers.

IS TRAWICK INTERNATIONAL A REPUTED INSURANCE COMPANY?

Trawick International is a full-service travel insurance company with a US base, that focuses on providing travel-related coverage for tourists, students, scholars, businesses, groups, and all other international visitors.

For overseas travelers, Trawick International Travel Insurance provides short-term visitor travel insurance. Travel medical coverage is a feature of Trawick’s International health insurance for individuals, businesses, groups, and researchers.

Travel insurance, trip cancellation insurance, and student travel medical insurance, visitor health insurance are all offered by Trawick International Insurance. For people traveling to the USA, those traveling overseas, US citizens traveling in the USA, and non-US citizens traveling from their home country, Trawick International has multiple plans with comprehensive coverage including sickness medical coverage

IS CORONAVIRUS COVERED BY SAFE TRAVELS USA COMPREHENSIVE?

As long as the virus is contracted after the policy’s effective date and you have left your home country,

COVID-19 is a covered condition under Safe Travels USA Comprehensive and it will be handled in the same way as any other qualifying medical condition.

IS COVID-19 COVERED IN TRAVEL INSURANCE PLANS FROM IMG?

Yes, IMG’s travel insurance covers COVID-19 just like any other disease. Imglobal offers travel health insurance solutions as well as trip cancellation insurance policies that cover both the expense of the trip and the traveler’s health (insurance only for the health of the traveler). Additionally, IMG offers items for ex-pats, exchange students, and foreign students.

IS THE SAFE TRAVELS USA COMPREHENSIVE PLAN AVAILABLE TO ME?

Any non-US citizen or any Indian who is temporarily visiting the USA may purchase the Safe Travels USA Comprehensive plan. For those who pay taxes in the US and are US citizens, US Green Card holders, or holders of long-term visas, it is not available.

WHAT BENEFIT DOES PURCHASING THE SAFE TRAVELS USA COMPREHENSIVE PLAN OFFER?

Safe Travels USA Insurance covers Cost-effective COVID-19 travel insurance. For travelers to the USA looking for affordable travel health insurance that includes coverage for COVID-19, Safe Travels USA Comprehensive by Trawick International is the best option.

WHO IS ELIGIBLE TO ENROLL IN TRAWICK INTERNATIONAL’S SAFE TRAVELS USA COMPREHENSIVE TRAVEL INSURANCE PLAN?

For non-US citizens and US residents going to the US or anywhere else outside their native country, Trawick International offers the Safe Travels USA Comprehensive travel insurance package. US citizens and US permanent residents(Green Card holders) cannot use Safe Travels USA.

CAN YOU EXTEND OR RENEW THE SAFE TRAVELS USA COMPREHENSIVE PLAN?

Yes, you can renew the plan for up to 364 days. Renewal of the Trawick International Safe Travels USA Comprehensive package costs $5.

WHICH IS A BETTER PLAN, COVER AMERICA GOLD OR ATLAS AMERICA?

Better health insurance depends on your travel insurance needs. CoverAmerica Gold is designed for travelers coming into the USA and has some unique features in the plan. Whereas, Safe Travels USA offers wide coverage and higher limits.

You can compare and buy visitor insurance from a reputed travel insurance marketplace like OnshoreKare.

Other Similar Plans to Consider?

Our licensed associates can help you select a plan, address your questions, and provide you with the information you need, feel free to:

- Call us on +1 (855) 652 5565

- WhatsApp your questions to +1 (417) 932 3109

Bottom Line

Travel medical insurance is one of the most important considerations when we travel, especially when we have family members visiting the United States.

Two of the most popular plans for international visitors to the United States are CoverAmerica Gold and Safe Travels USA. With larger coverage limit selections, Safe Travels USA’s health care costs coverage outperforms Cover America Gold and it offers the flexibility of a higher policy maximum of up to $1mn as compared to $250,000 only with CoverAmerica Gold.

Always travel under the cover of insurance!